International investing provides investors with many benefits, such as diversification, access to different technologies, and potentially higher returns. Despite this opportunity, investors tend to exhibit a "home bias" and have maintained an allocation to their home nation that is potentially more than warranted. While not one specific geographical security allocation suits all investors, it is essential to remain open and examine the possibilities that international investing can achieve.

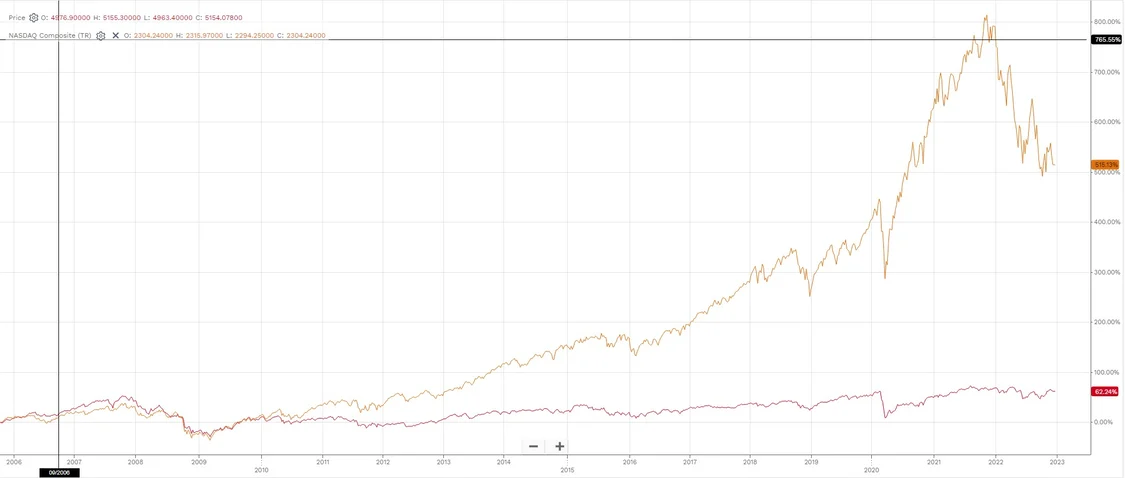

One primary motivation for international investing is the diversification benefits it can provide to a portfolio. When looking domestically, securities are exposed and driven by the economic and market forces of the investors' domiciled market. Therefore, when you increase international exposure, your returns are driven by a more comprehensive array of economic and market forces, which then have the potential to generate returns than vary compared to solely domestic exposure. The graphic below juxtaposes the difference between the ASX 200 (red line) and the Nasdaq composite (orange line) since 2006. Incorporating a U.S. allocation (in this case) would have provided investors with exposure to the market forces driving the Nasdaq, subsequently altering their investment returns.

ASX 200 vs. Nasdaq Composite historic total returns – Source: Factset

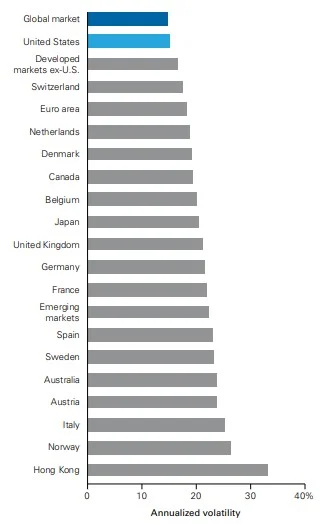

Additionally, international investing can potentially generate lower volatility than a sole allocation to a single geographical location. This is due to the typically low correlation between geographies.

Volatility of returns by market – Source: Vanguard

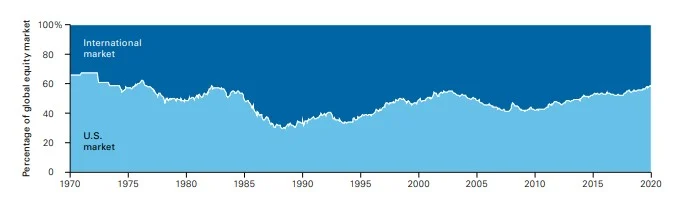

While international investing provides diversification benefits, it also allows investors access to a more comprehensive opportunity set. Utilising data from 2020, the large developed markets accounted for 58.3% (the U.S.), 8.6% (Euro area), 3.5% (the United Kingdom), 2.7% (Canada), and 1.8% (Australia). Solely investing in one region excludes a large percentage of the remaining global market and limits opportunities. An example of this is illustrated by comparing the Australian market, primarily composed of banks, retail, resource and energy companies, to the U.S. market. The U.S. market is home to some of the most innovative companies, such as Tesla and Apple. Failing to incorporate exposure to this market removes the opportunity to benefit from their innovation and returns.

Historical mix of global equity market capitalisation – Vanguard

An often-overlooked element of international investing is the potential additional return generation from currency appreciation. When the value of your overseas investment appreciates due to positive return, and the currency appreciates against your home currency, you will generate extra returns upon selling the security.

Three international companies we believe are long-term structural winners are LVMH Moet Hennessy Louis Vuitton SE (contained within 'Luxury Goods' Vue), Apple (contained within 'Warren Buffet Top 10' Vue), and Tesla (contained within 'Car of the Future' Vue).

LVMH (EPA: MC)

The LVMH Group was formed through the merger of Moet Hennessy and Louis Vuitton in 1987. Today, the Group has established a market-leading position through its unique portfolio of 76 Maisons, which operate within six groups. The six groups within LVMH are Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewellery, Selective Retailing, and Other activities. In each of the respective groups, LVMH has established a highly competitive or leading market position. LVMH remains one of the most dominant players within the luxury goods space. This can be characterised by its scale, strong presence in every industry segment, and ability to allocate capital efficiently within the business. Within luxury goods, being a part of a multi-brand approach provides benefits such as shared learning and incremental growth. It also allows a greater ability to market and expands your products. Louis Vuitton has one of the largest marketing spends within the space allowing it to continuously promote its brands and attract new customers within its ecosystem.

Apple (NASDAQ: AAPL)

Apple designs, manufactures, and markets consumer technology products, including smartphones, tablets, personal computers, wearable devices and entertainment devices. The Group generates robust margins, has immense brand loyalty and continues to innovate its products year after year. While supply problems in China have caused headwinds, we believe that these are likely to be transitory and will resolve themselves in the near future. Looking forward, the Group has the capability and financial resources to continue expanding its product lines and monetising its consumer base through new offerings and services.

Tesla (NASDAQ: TSLA)

Tesla develops, manufactures and sells high-performance, fully electric vehicles and energy generation and storage systems. The Group emphasises performance, attractive styling and the safety of its users and workforce in the design and manufacture of its products. It is also attempting to develop full self-driving technology for improved safety. While recent negative headlines have surrounded the Group (primarily due to Elon Musk purchasing Twitter), we believe it will remain a market leader in the longer term. In the near term, Tesla continues to execute its growth trajectory by ramping production in its Giga-Factories, expanding its product offering (the first deliveries of the Tesla Semi were in December 2022), and being eligible for the new EV tax credits. Additionally, Dojo, the Tesla AI supercomputer, continues to learn from every mile a Tesla drives on the road in the pursuit of achieving full autonomous self-driving.

While international investing has benefits, it's important to remember that it carries its own set of risks, such as currency, political, and economic risks. It's essential to carefully consider these risks and your own investment goals and risk tolerance before making any investment decisions.

Important Information

All information contained in this publication is provided on a factual or general advice basis only and is not intended or be construed as an offer, solicitation, or a recommendation for any financial product unless expressly stated. All investments carry risks and past performance is no indicator of future performance. Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice. Opinions, estimates and projections constitute the current judgement of the author as at the date of this publication. Any comments, suggestions or views presented in this communication are not necessarily those of HALO Technologies, Macrovue or any of their related entities (‘we’, ‘our’, ‘us’), nor do they warrant a complete or accurate statement.

The opinions and recommendations in this publication are based on a reasonable assessment by the author who wrote the report using information provided by industry resources and generally available in the market. Employees and/or associates of HALO Technologies or any of the other related entities may hold one or more of the investments reviewed in this report. Any personal holdings by HALO Technologies or any of the other related entities employees and/or associates should not be seen as an endorsement or recommendation in any way. HALO Technologies Pty Limited ACN 623 830 866 is a Corporate Authorised Representative CAR: 001261916 of Macrovue Pty Limited ACN:600 022 679 AFSL 484264. MacroVue Pty Limited is a wholly owned subsidiary of HALO Technologies Pty Ltd. These companies are related entities with Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG)