India is and remains poised to be one of the world’s fastest growing economies over the coming years and the performance of their domestic companies reflects this upbeat outlook with strong revenue growth and expanding earnings. With a growing middle class and a predominately domestic centered economy, it would not be surprising if positive returns continue in the upcoming period in spite of a slowdown in the global macroeconomic environment with the region providing possible diversification benefits to many investors’ portfolios.

The portfolio of companies that have been selected for the HALO Technologies “India” portfolio has outperformed the S&P 500 and the M.S.C.I. All Country World Index over the previous 12-months by posting a return of 15.11%* compared to the 2.30% and -4.56% return of the two benchmarks respectively.

The portfolio outperformed the benchmarks by a significant margin and was a great theme to be invested in over the previous 12-months. Off the back of the strong equity markets at the end of CY2020 and throughout CY2021, the start of CY2022 was not so accommodating with negative performance across most sectors and economies with the S&P 500 eking out a positive 12-month result but only after a strong July which has carried through to August. This positivity was not experienced when investors were concerned over their portfolios in the month prior where conditions looked grim.

The largest underperformer in the portfolio was HDFC Bank (HDB), but given the global economic conditions, the negative single digit return is not of significant concern and is in fact a positive result when factoring in the investing environment we endured. Each of the underperformers are facing their own headwinds, and while some may be persistent, we refrain from making changes to the portfolio before we evaluate the impacts over a longer time horizon and assess how each respective management team steer their companies over the less-than-ideal terrain. Our expanded thoughts are available for each in the Company News section below.

On the other end of the spectrum, Mahindra & Mahindra (MHID) has returned more than its fair share over the previous five months since it was added into the portfolio. While it would be great to see the strong results continue, it is unlikely they can maintain gains of this magnitude and we expect performance to normalise in the future.

As for India, the country is forecasted to be the fastest growing economy in the world with an average growth rate of 7.1% to 7.6% in FY2022 to FY2023 and 6% to 6.7% in FY2023 to FY2024 based on Deloitte estimates. Contrast to this is a slowdown for several major economies and possibility of recessions and the attractiveness of India remains. The country is not immune to factors that others are experiencing such as rising inflation and supply chain disruptions with growth downgraded from prior forecasts, however, a strong domestic demand (70% of economic activity generated domestically) will help reduce external global shocks which then improves the investment attractiveness of the region from global investors and further aids in the self-fulling cycle for strong returns.

Company News

HDFC Bank Limited (HDB)

HDFC Bank reported Q1 FY2023 earnings on 16 July, 2022.

Total revenue (net interest income and other income) for the quarter was Rs 25,869 crores ($3.25B). Core revenue (excluding trading and mark to market losses) grew 19.8% to Rs 27,181 crores ($3.41B).

Net interest income rose 14.5% to Rs 19,481 ($2.45B), which was driven by advances growth of 22.5%, deposit growth of 19.2% and total balance sheet growth of 20.3%.

New liability relationships continued to be added with 2.6M in the recent quarter which is 59% than last year. Cards also saw positive results with new cards issued experiencing the highest quarter ever at 1.2M or 47% growth Y/Y with total issued standing at 17.6M.

Net income rose 20.9% Y/Y to Rs 9,579 crores ($1.2B).

Expansion continues with 36 branches added and 250 more are in various stages of readiness to be rolled out. Overall payment acceptance points increased 42% to 3.2M.

By the numbers, HDFC Bank is performing well and continues to grow their networks and loan book despite various industries facing headwinds (i.e., supply chain issues affecting the automotive industry). The trajectory for the company remains on track and we are not concerned by the decline in the share price and expect performance to improve moving into the future.

Infosys Limited (INFY)

Infosys reported Q1 FY2023 earnings on 24 July, 2022.

Revenue for the quarter grew 17.5% Y/Y from $3,782M to $4,444M as all business segments grew double-digits in constant currency with several posting 25% or higher. Margin stood at 20% which was a 150-basis point decline off of salary increases, drop in utilisation due to creation of future capacity and higher subcontractor third-party costs.

Earnings per share declined $0.01 Y/Y to $0.16, however, the appreciating US Dollar contributed notably to the decline. In Indian Rupees, earnings per share rose 4.4% to Rs 12.76.

The demand environment remains healthy with both the U.S. and Europe markets growing strong at 18.4% and 33.2% respectively and Digital revenues accounted for 61% of the total with 37.5% growth over last year and within that the segment Cloud continues to grow faster still.

Large deals amounted to $1.69B, comprising of nineteen large deals with 50% of them new. The overall pipeline remains strong but there is weakness present in certain areas such as mortgages in financial services but on the other end manufacturing and communication were the outperformers.

Off the strong Q1 and along with the current demand opportunity and pipeline, management increased revenue growth guidance from 13% to 15% to 14% to 16%. Margins are expected to remain within the targeted range of 21% to 23% but due to the cost environment will likely place at the lower end.

Although inflation and salary increases will affect Infosys and the Indian IT industry more so than others, we remain positive on the area as the transformation to digital continues its momentum around the world. The headwinds faced by Infosys are those that are also affecting others which should spur spending by organisations so that they can streamline processes and procedures in an effort to reduce expenses. This could directly increase Infosys’s revenue through new deals; thus, the negative impacts being experienced could also be a silver lining.

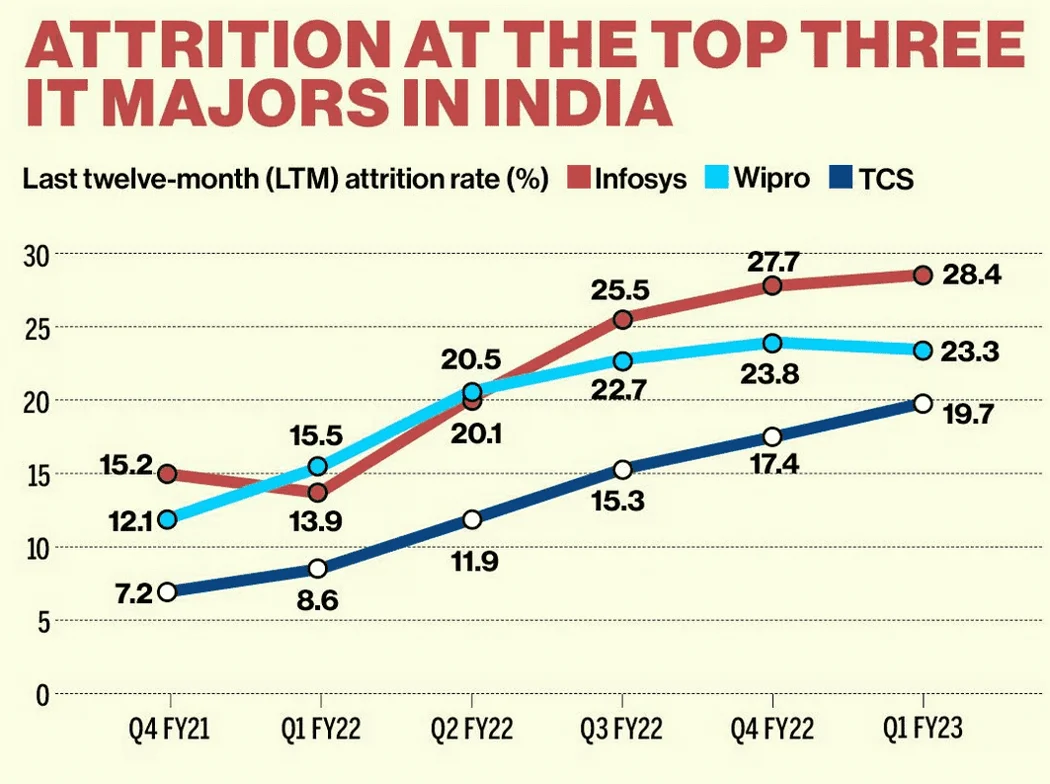

However, with employee churn and salaries rising, this is an area in which we will monitor as improvement is needed in the upcoming quarters. The good news is that churn is no longer accelerating but the current levels far exceed those from previous times and while this is an industry wide issue, Infosys is faring the worst and we would like to see the metric revert back towards their historical value which in turn will alleviate pressure on their margins.

Source: Indian IT Churn rate as of June, 2022, BusinessToday.Im

Dr Reddy’s Laboratories Limited (RDY)

Dr Reddy’s Laboratories reported Q1 FY2023 results on 31 July, 2022.

Consolidated revenue was $660M which was a 6% increase Y/Y but declined 4% on a sequential basis. The quarter was impacted by additional competition in key products in the U.S., inflationary pressures, and a slowdown of growth in the Indian pharmaceutical market. Additionally, the revenue growth is being compared to a higher base in the previous period last year which included sales of COVID products and higher sales in Russia.

Gross margin declined 230 basis points Y/Y to 49.9% with several one-off impacts causing the decline. Rising commodity prices and adverse leverage on manufacturing overhead due to a lower sales pace also affected margins. These impacts should normalise with commodity prices alleviating in recent weeks and sales expected to improve in the next quarter, thus, gross margin should trend towards its normal range.

Profit before tax was $155M, which is 97% growth Y/Y but this includes one-time settlement income and bank divestments that are not expected to occur next year.

New product launches continue in the U.S. which will ramp up in the coming quarters. This should aid in offsetting the increased competition seen in their key products which attributed to a 2% revenue decline Y/Y to $250M, thus, the business has the possibility to grow in the region despite the long-term competition headwind.

Europe performed better with 12% growth to €50M and nine new products were launched across various countries. Emerging markets experienced a 1% decline off the back of a higher base due to COVID product sales but on an annual basis, results in the region should normalise.

India was a solid performer growing 26% Y/Y to Rs 1,334 crores or $168M and management continues to reshape the portfolio by focusing on growing big brands, acquisitions, and partnerships while continuing to divest away from non-core brands.

It was a tough quarter for Dr Reddy’s Laboratories with multiple headwinds converging on the period but prior comparisons should ease as COVID sales abate and then a further down the line, the Russian sales that were lost will also be reflected in the Y/Y growth. Drug patents are continuously expiring which provides the company a healthy potential pipeline of products, thus, we are not overly concerned by the increased competition in the U.S. at this time but we will track progress of their market share for the upcoming quarters and revaluate if it deteriorates significantly.

Mahindra & Mahindra Limited (MHID)

Mahindra & Mahindra reported Q1 FY2023 earnings on 05 August, 2022.

Mahindra & Mahindra’s (M&M) Q1 revenue was Rs 18,995 crores ($2.38B), which was up 67% Y/Y from Rs 11,765 crores ($1.48B) last year.

Net income was Rs 1,430 crores ($179.5M) which was up 67% Y/Y.

The Farm segment revenue was Rs 6,689 crores which was up 25.8% Y/Y and profit after tax was Rs 1,074 crores which was relatively flat Y/Y. Market share for Farm Equipment Sector (FES) Tractors saw a 0.9% rise Y/Y to 42.7%. Domestic quarterly volumes were the highest ever at 112,300 sold, up 18% Y/Y.

Automotive revenue was Rs 12,306 crores which was up over 100% Y/Y and profit after tax was Rs 703.55 crores. M&M continues to be the number in SUV’s based on revenue with market share of 17.1% and Automotive delivered the highest quarter ever with 75,400 SUVs and 46,000 Pik-ups sold representing 77.2% and 79.7% growth Y/Y respectively. Demand for the automotive products remains strong with 140,000 open bookings (XUV300, XUV7000, THAR, BOLERO AND SCORPIO) excluding the Scorpio-N which successfully launched in the quarter.

The company is off to a great start in the portfolio and given the performance there is not a lot to say. The future looks bright for the company and we expect continual execution from the management team but returns should normalise over the coming periods.

MakeMyTrip Limited (MMYT)

MakeMyTrip reported Q1 FY2023 earnings on 27 July, 2022.

MakeMyTrip’s Q1 revenue was $142.7M, up 335% Y/Y, and gross bookings reached $1,612.5M which saw a vast increase from $286.7M a year ago. As the results suggests, the company saw a strong recovery in leisure travel in domestic destinations as well as improving demand in short haul international destinations in Southeast Asia, UAE and Nepal, etc.

Although the results show large Y/Y increases, it is important to be aware of the easy FY2022 comparison. Q/Q growth metrics demonstrate recent improvements with gross bookings increasing 63.3%. Furthermore, the business operates in Indian Rupees and reports in United States Dollars and with the weakening of the rupee, a negative translation impact has taken place.

The Air segment saw recovery to over 90% of pre-pandemic levels with $30.9M of revenue posted in the quarter, which was a 110% increase Y/Y. The improvement was primarily due to higher gross bookings as domestic travel recovered strongly as COVID-19 conditions in India diminished.

Hotels and Packages revenue improved to $84M, a 638.9% increase Y/Y. The gain was primarily from higher gross bookings and an increase in the number of hotel-room nights.

Bus Ticketing revenue was $20.3M which rose 383.8% Y/Y as the number of bus tickets increased 351.1% Y/Y due to strong recovery in domestic travel.

Other revenue was $7.5M which was a 191.7% increase Y/Y, primarily from higher advertising revenue, other ancillary services, and brand alliance fees.

Globally and in India, governments and central banks are increasing efforts to tame inflationary pressures, if the countermeasures are effective then lower oil prices should lead to improved domestic and international travel demand due to improved pricing.

Management estimates that travel demand, both domestically and internationally, should recover to pre-pandemic levels by the end of this year. Corporate travel momentum should rise over the coming quarters and will aid in the overall demand.

Tata Motors Limited (TTM)

Tata Motors reported Q1 FY2023 earnings on 27 July, 2022.

Q1 consolidated revenue was Rs 71,900 Cr ($9.03B), up 8.3% Y/Y, as Jaguar Land Rover (JLR) experienced a light quarter due to supply chain challenges, semiconductor shortages, slower ramp-up of production and China lockdowns. On the opposite side, Tata Commercial Vehicles (CV) and Tata Passenger Vehicles (PV) both continued strong momentum despite present headwinds.

JLR vehicle sales were 78,825, flat against Q4 FY2022 but down 37% when compared against Q1 FY2022. This in turn affected revenue which was down 7.6% Y/Y to £4.4B as the aforementioned challenges impacted operations. Loss before tax was £524M, primarily reflecting lower wholesale volumes with weaker mix, as well as unfavourable inflation and currency and commodity revaluation. Production ramp-up for the New Range Rover and Range Rover Sport was slower than anticipated and management is actively working to resolve the issue and is expecting better results in the future as chip supply improves. Demand remains strong with a record 200,000 client orders, with Range Rover, Range Rover Sport and Defender the most popular.

Tata CV experienced strong growth compared to the previous COVID impacted quarter which was broad-based across regions and segments. The India domestic business wholesales were 95,895 vehicles which was up 124% Y/Y. Exports slid 22.6% to 5,218 vehicles as financial crisis in a few export markets affected demand. All totalled, 103,700 vehicles were sold which was up 100.3% Y/Y.

Tata PV’s momentum also continued with wholesales at 130,351 vehicles, up 101.7% against the prior year period with electric vehicle (EV) sales showing positive growth of 444% to 9,300. Demand was strong even as the supply side was moderately impacted.

Despite inflation worries and geopolitical risks, management expects the supply situation to improve and alleviating commodity prices should aid margin improvement in future quarters.

Important Information

All information contained in this publication is provided on a factual or general advice basis only and is not intended or be construed as an offer, solicitation, or a recommendation for any financial product unless expressly stated. All investments carry risks and past performance is no indicator of future performance. Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice. Opinions, estimates and projections constitute the current judgement of the author as at the date of this publication. Any comments, suggestions or views presented in this communication are not necessarily those of HALO Technologies, Macrovue or any of their related entities (‘we’, ‘our’, ‘us’), nor do they warrant a complete or accurate statement.

The opinions and recommendations in this publication are based on a reasonable assessment by the author who wrote the report using information provided by industry resources and generally available in the market. Employees and/or associates of HALO Technologies or any of the other related entities may hold one or more of the investments reviewed in this report. Any personal holdings by HALO Technologies or any of the other related entities employees and/or associates should not be seen as an endorsement or recommendation in any way. HALO Technologies Pty Limited ACN 623 830 866 is a Corporate Authorised Representative CAR: 001261916 of Macrovue Pty Limited ACN:600 022 679 AFSL 484264. MacroVue Pty Limited is a wholly owned subsidiary of HALO Technologies Pty Ltd. These companies are related entities with Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).