Throughout the course of history, there have been numerous technological cycles promising, or threatening, to reshape the corporate landscape. From the dot-com boom to the mobile revolution and the advent of cloud computing, the initial market reaction is almost always characterized by a bifurcation between breathless hype and apocalyptic fear. The current discourse surrounding Artificial Intelligence is no exception.

Recently, we have observed sharp, correlated selloffs across diverse sectors, including Software (see annotated image below), Financial Services, Real Estate, and Logistics. The prevailing narrative driving this volatility is broadly characterized as "AI displacement fear." The market is currently pricing in a scenario where generative AI acts as a universal solvent, dissolving incumbent business models, automating away service revenues, and rendering traditional operational structures obsolete.

IGV: iShares Expanded Tech-Software Sector ETF

As an Equity Analyst focused on long-term value creation, my role is to look beyond immediate sentiment and analyse fundamental competitive dynamics. While it is undeniable that AI will cause significant dislocation and replace certain business functions, the current market reaction is a gross oversimplification.

The reality of AI adoption will not be a uniform wave of destruction. It will be a complex sorting process. We must differentiate between businesses whose core value proposition is easily replicated by an LLM, and those incumbents possessing durably dug moats, proprietary data, regulatory standing, or embedded physical infrastructure, that will allow them to harness AI as a powerful tailwind for efficiency and margin expansion.

The Nuance of Adaptation vs. Displacement

The market’s current "sell first, ask questions later" approach misses critical nuances in how enterprises adopt technology. We see three primary categories of incumbents that are currently being mispriced:

1. The "Toll Booths": AI models are ravenous for data. Companies that possess unique, proprietary, high-fidelity datasets are not victims; they are essential infrastructure. As AI agents require continuous API calls to access real-time data to function, these data owners stand to generate high-margin, recurring revenue streams akin to a digital toll booth.

2. The Efficiency Integrators: For many mature industries, the primary impact of AI will not be revenue displacement, but massive cost reduction. By integrating AI into back-office administration, compliance, and logistical planning, incumbents can significantly improve operating margins without fundamentally changing their product.

3. The Resilient Moats: Some businesses rely on trust, regulatory capture, or physical networks that an algorithm cannot simply replicate overnight.

To illustrate this mispricing, let us examine two distinct sectors recently hit by the AI narrative: Financial Services and Logistics.

Case Study: S&P Global (SPGI) – The Power of Durable Moats

Financial stocks have been pressured by the idea that AI will democratize financial analysis, rendering traditional market intelligence firms obsolete. S&P Global (SPGI) has not been immune to this sentiment.

It is true that parts of SPGI’s "Market Intelligence" division face competitive pressure from AI tools that can rapidly synthesize public financial data. However, viewing SPGI solely through this lens ignores the majority of its business, which is fortified by deep competitive moats. SPGI is far more than just a data aggregator. Its core value stems from its Ratings and Indices businesses.

Ratings: The credit ratings business operates in an oligopolistic market structure reinforced by regulatory requirements. Bond issuers need a rating from a recognized agency like S&P or Moody’s to access capital markets. An AI model cannot provide the regulatory stamp of approval required by institutional investors.

Indices: The shift toward passive investing has made the S&P 500 and other indices vital financial infrastructure. SPGI earns high-margin licensing fees whenever an ETF tracks their indices or derivatives are traded based on them. This is an incredibly sticky, recurring revenue stream.

Furthermore, the market ignores the upside. Financial services are burdened by immense administrative and compliance costs. SPGI is actively deploying AI to streamline these back-office functions, which should lead to structural improvements in their already impressive operating margins over the medium term. Additionally, they have a licencing agreement already in place with the very AI company who caused downward pressure on their share-price.

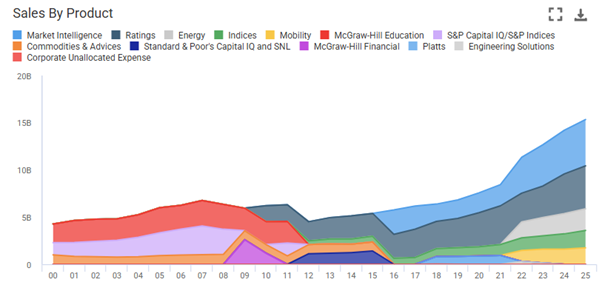

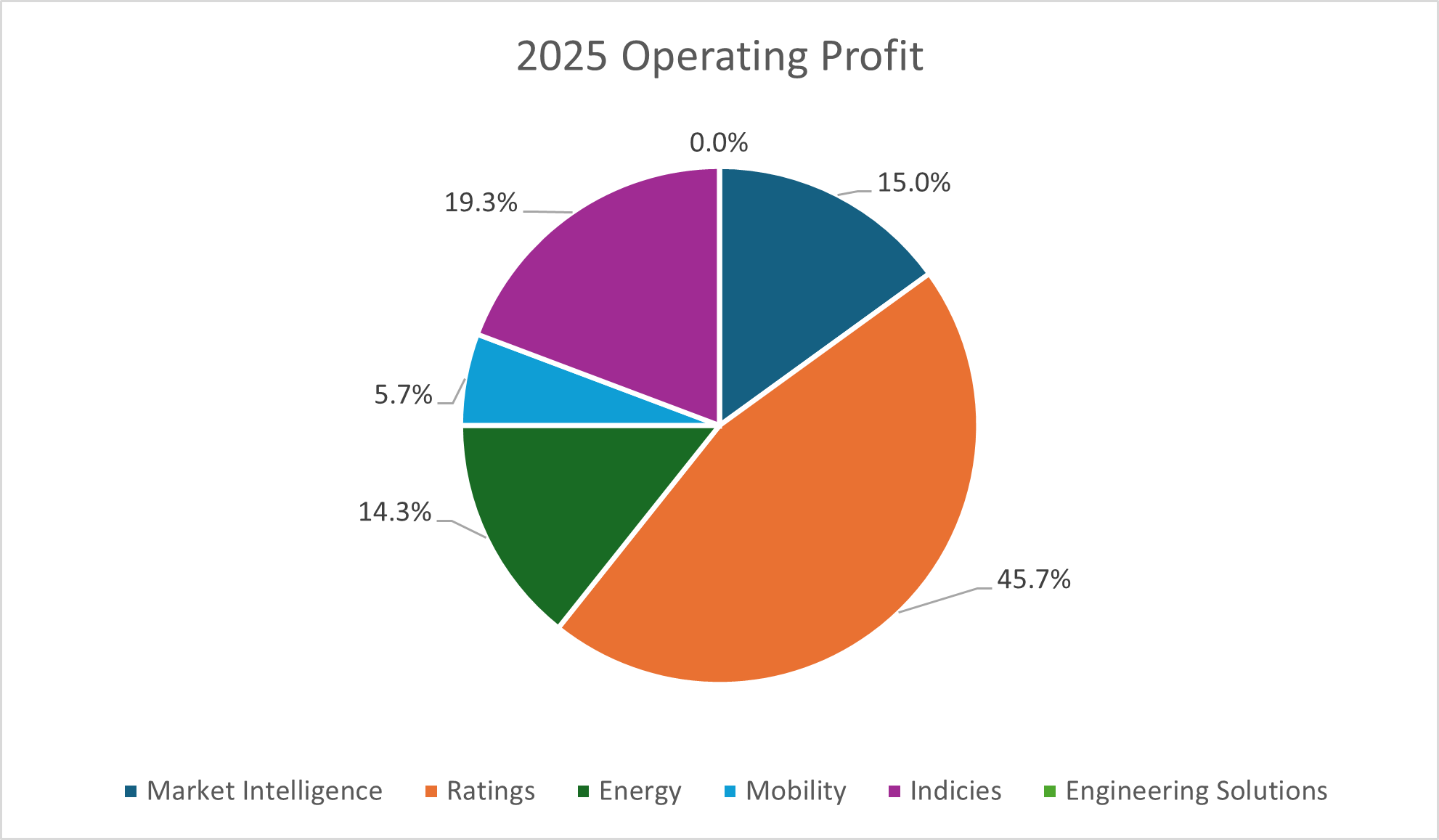

To visualize the resilience of SPGI, one must look at where their profits actually come from. While Market Intelligence is significant revenue-wise, the operating profit contribution is heavily skewed toward their highest-moat businesses.

SPGI Sales by Product

Source: Halo Technologies

SPGI Operating Profit Breakdown

Source: Company reports

As the profit contribution chart demonstrates, over 55% of SPGI’s operating profit stems from Ratings and Indices, businesses highly resistant to AI disintermediation. Selling SPGI based on fears concerning a sub-segment of its Market Intelligence division is a fundamental misreading of the company's earnings durability.

Case Study: Logistics and Trucking – The Reality of Physical Networks

The logistics sector has also seen significant selling. The bearish thesis suggests that AI-driven route optimization and supply chain visibility tools will so heavily streamline freight operations that it will pressure revenue lines for major carriers and brokers.

This view suffers from "technological utopianism." It forgets that logistics is fundamentally a business of physical reality and deeply embedded human relationships.

A sophisticated AI algorithm may calculate the perfect route, but it cannot physically move pallets from a warehouse in Ohio to a retailer in Texas. The incumbents possess the trucks, the terminals, the drivers, and crucially, the trusted relationships with shippers built over decades.

Rather than displacing these companies, AI acts as a potent tool for them. The major logistics players are best positioned to implement AI to optimize load matching, predict maintenance needs before trucks break down, and automate brokerage transactions. The result isn't necessarily lower total sector revenue; it is the ability for incumbents to handle higher volumes at significantly lower costs per unit, driving margin expansion and taking market share from smaller, less technologically capable competitors.

Conclusion: Discipline Over Emotion

AI has the ability to reshape industries and drive profound efficiencies. We are in the early innings of a transformative era. However, history teaches us that panicked selling of high-quality businesses due to generalized technological fears is rarely a winning strategy.

As investors, we must remain unemotional and think logically about the second-and third-order effects of this technology. We must distinguish between businesses selling easily commoditized outputs versus those controlling essential data, infrastructure, and regulatory positioning. The current volatility is creating opportunities to acquire the latter at attractive valuations.

Important Information & Disclosure

This report is issued by HALO Technologies Pty Ltd ABN 54 623 830 866, a Corporate Authorised Representative (No. 1261916) of Macrovue Pty Limited ABN 98 600 022 679, AFSL 484264. Financial services are provided under Macrovue’s Australian Financial Services Licence.

General Advice Warning

This report contains general financial product advice only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on any information in this report, you should consider the appropriateness of the information having regard to your objectives, financial situation and needs and seek independent professional advice if necessary.

Nothing in this report constitutes personal financial product advice or creates a fiduciary relationship between HALO and any recipient.

Recommendations & Ratings

This report may contain financial product recommendations, including Buy, Hold or Sell ratings.

Rating Definitions (12-month investment horizon unless otherwise stated):

Buy – Expected to deliver returns materially above its relevant benchmark or peer group.

Hold – Expected to perform broadly in line with its relevant benchmark or peer group.

Sell – Expected to underperform its relevant benchmark or peer group.

Ratings reflect HALO’s opinion at the date of publication and are subject to change without notice.

Reasonable Basis Statement

HALO has prepared this report using information from sources believed to be reliable and has applied a reasonable basis for its opinions and recommendations, including consideration of relevant assumptions and risks. However, no representation or warranty is made as to the accuracy, completeness or timeliness of the information.

Risks & Performance

All investments involve risk. The value of investments and the income derived from them may rise or fall and investors may not recover the full amount invested.

Past performance is not a reliable indicator of future performance.

This report may contain forward-looking statements, forecasts or price targets which are based on current assumptions and market conditions and involve known and unknown risks and uncertainties. Actual results may differ materially.

Product Disclosure & Target Market

Where a financial product is referred to in this report, you should obtain and consider the relevant Product Disclosure Statement (PDS) before making any decision in relation to that product.

A Target Market Determination (TMD) may apply to certain financial products. You should review the TMD to assess whether the product is likely to be consistent with your objectives, financial situation and needs.

Conflicts of Interest

HALO and/or its associates may hold positions in the financial products referred to in this report and may receive remuneration in connection with financial services provided. HALO maintains policies and procedures designed to identify and manage conflicts of interest in accordance with its regulatory obligations.

Further information regarding financial services provided by HALO is available in the Financial Services Guide (FSG) available at www.halo-technologies.com.

Limitation of Liability

To the maximum extent permitted by law, HALO and Macrovue exclude all liability for any loss or damage arising directly or indirectly from reliance on this report.

Copyright

No part of this report may be reproduced or distributed without the prior written consent of HALO Technologies.

.png)