Unbeknown to many consumers, electric vehicles (EVs) can be traced back to the 1800s and are not an entirely new method of transportation. The battery chemistry used has evolved throughout this period from lead acid to lithium-ion, and the first production car to utilise lithium-ion batteries was the Tesla Motors Roadster, which began production in 2008. The decision to use lithium-ion batteries instead of lead acid can be reduced to three primary drivers.

When comparing the two chemistries side-by-side, energy and range advantages are the first and second drivers. The first driver, energy, refers to the battery's energy density. Energy density relates to the amount of energy contained within a given volume. Lithium-ion batteries have an average energy density of 250-670 Wh/L compared to 50-90 Wh/L for lead acid. This difference indicates that if you were driving an identical vehicle, a lead acid battery would require approximately 10x the volume compared to the lithium-ion battery. This increase in volume would also increase the weight of the battery. Subsequently, this would reduce the available weight of other vital components, such as payloads or passengers. On the other side of the equation, the lithium-ion battery would allow space for the crucial other components, given its higher energy density. Range, the second primary driver, also relates to energy density. A greater energy density provides range advantages due to the reduced charging requirement attributable to the greater amount of energy stored within the battery. The last driver of the switch between battery chemistries is the charging rate. The rate at which a lithium-ion battery charges has been documented to be nearly 4x faster than a lead-acid battery. A faster charging rate is more attractive for time-sensitive applications with a higher utilisation rate.

With the decision to utilise lithium-ion batteries made, the penetration of EVs and hype around lithium has increased throughout the years. Investors around the globe have poured capital into lithium companies, and some impressive returns have been achieved. Despite this, the industry still has growth opportunities and headwinds ahead of it on both the supply and demand sides.

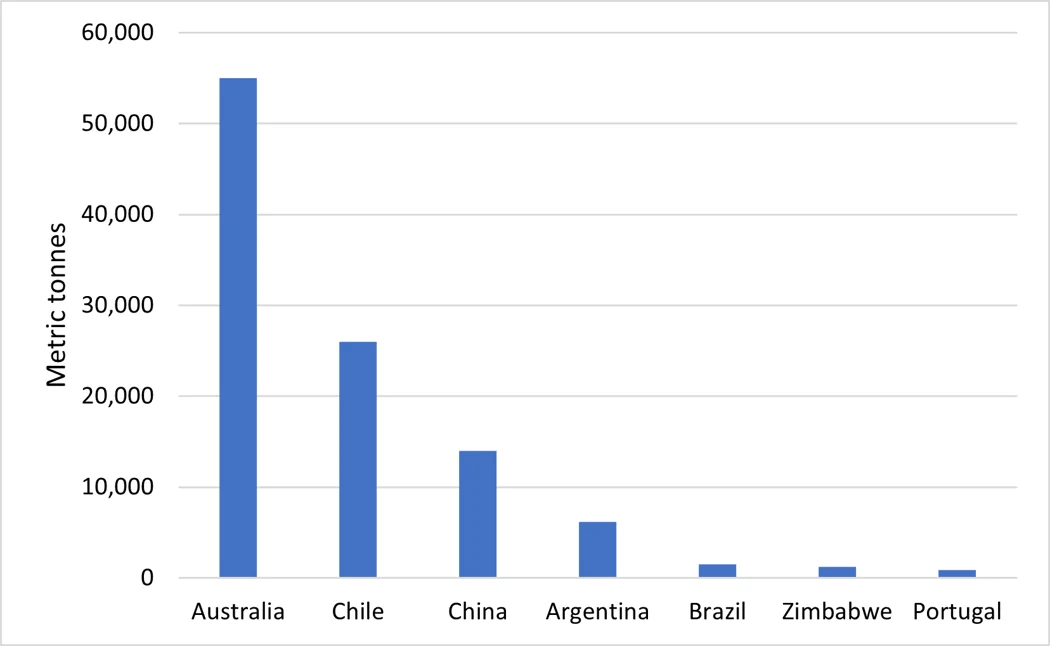

Out of the lithium-containing ore bodies, spodumene ore is usually the most economically viable source of lithium. While lithium-containing ore deposits have been found on every continent, a handful of nations are responsible for its current supply state. Australia and Chile have led the way in terms of production and reserves, with Australia utilising ore mining and Chile using salars (salt deserts).

Major Lithium Producing Countries 2021 – Source: Statista

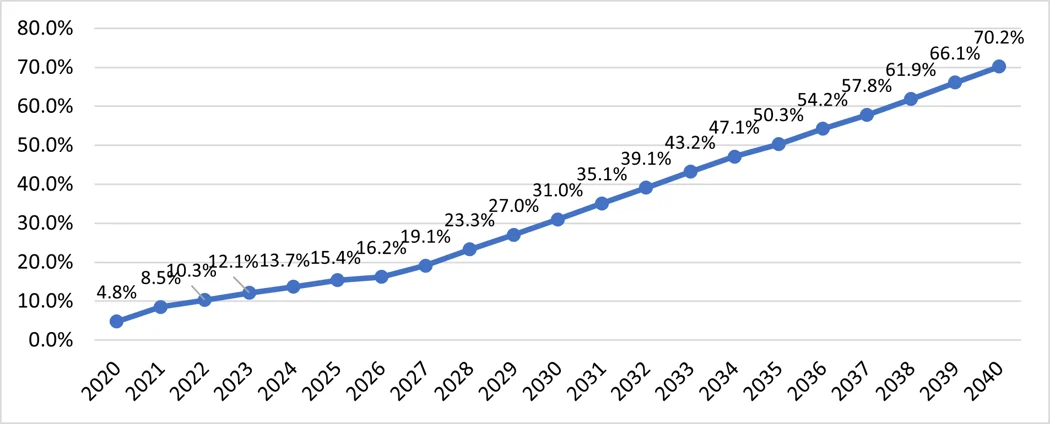

Despite research indicating ample lithium reserves for the EV rise, the rapid growth of demand may push the industry into a supply shortage due to the inelastic nature of supply. A sustained deficiency would cause the material price to remain high until this dynamic was brought back into balance. In recent times, the lithium price has experienced a momentous appreciation driven by the sustained demand for EVs, battery storage and China's worst heatwave in approximately 60 years.

Forecast: EVs as a percent of total passenger vehicle sales – Source: S&P Global Market Intelligence Aug 2021

With fundamentals looking positive over the next decade, three lithium stocks strategically positioned to benefit are Sociedad Quimica y Minera de Chile S.A (SQM), Albemarle and Pilbara Minerals.

Sociedad Quimica y Minera de Chile S.A (SQM)

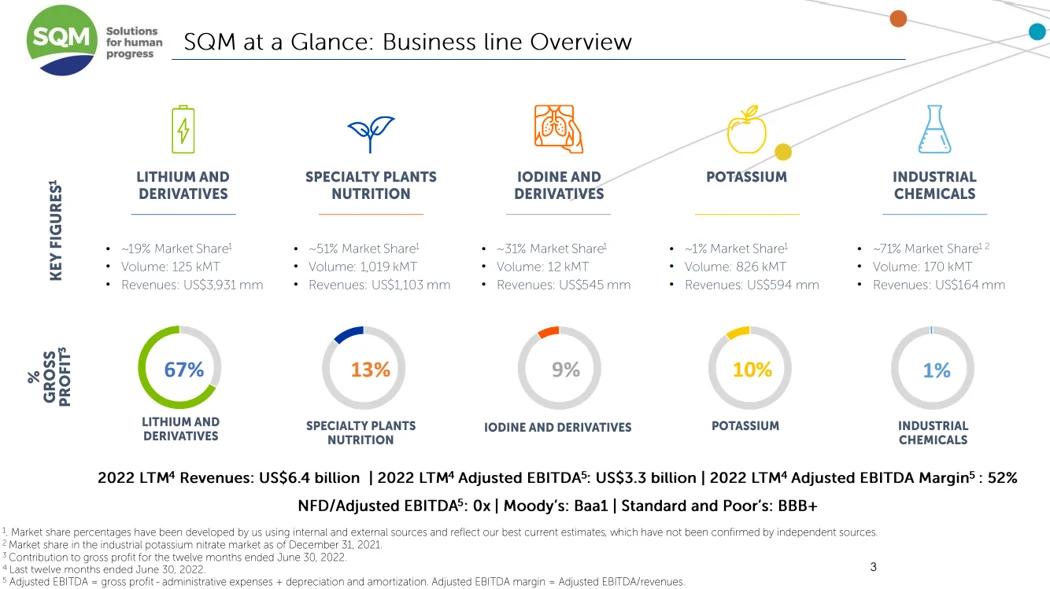

SQM is an "integrated producer and seller of speciality plant nutrients, iodine, lithium, potassium fertilisers, and industrial chemicals". The company is one of the world's largest lithium producers, and its products are sold through its global distribution network. The Groups products are derived from mineral deposits located in Northern Chile and mines high concentrations of lithium from the brine deposits of the Salar de Atacama.

We are positive on SQM given its competitive positioning as a lithium player supported by the strong anticipated tailwind of EV and battery storage demand over the next decade. In 2021, revenue generated from lithium and derivatives increased to 33% compared to 26% in 2019. The Group is looking to increase volume growth by approximately 20% in 2023/2024e, which will drive the contribution to revenue from the lithium and derivatives division higher. Additionally, to support this new capacity and to expand its geographic footprint, the Group acquired a converting plant in China which will be fed directly from its Chilean operations via lithium sulphates. Lastly, SQM has adopted a flexible pricing strategy resulting in approximately 90% of its volumes being exposed to a spot/ indexed price. This will continue to benefit the company while supply and demand remain tight. Another appealing quality of the Group is its position as the world's largest producer of iodine, representing 15% of overall revenues and 31% of total global sales by volume in 2021. The primary use of iodine is in areas such as X-rays, LCD and LED screens, pharmaceuticals, iodophors and povidone-iodine. The Group's competitive positioning within this space represents another attractive growth avenue.

Risks to the investment case of SQM include weaker-than-expected lithium markets and lower prices, a slower ramp-up of lithium facilities, weaker iodine markets, and unfavourable business conditions within Chile.

SQM Business Overview – Source: SQM Investor Presentation 2022

Albemarle Corporation (ALB)

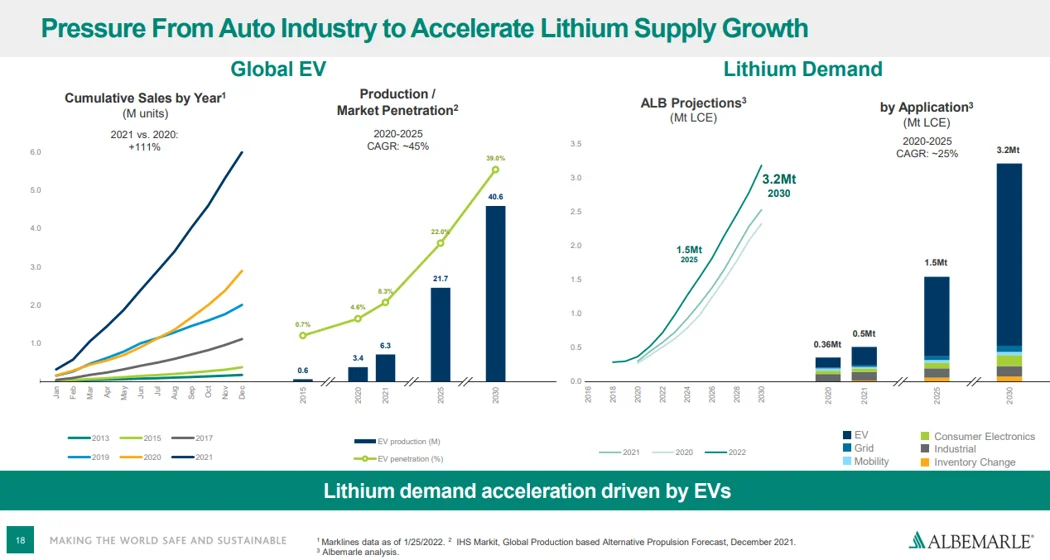

Albemarle Corporation is the second name which we believe is strategically positioned to benefit from the surging EV demand.

Albemarle Corporation is a prominent global developer, manufacturer and marketer of highly engineered speciality chemicals designed to meet its end customers' needs across various end markets. The company has three distinct business segments: lithium, bromine and catalysts. Albemarle's lithium business "develops lithium-based materials for a wide range of industries and end markets." It is also "a low-cost producer of one of the industry's most diverse product portfolios of lithium derivatives". The Group obtains lithium through solar evaporation of its ponds at the Salar De Atacama in Chile and Silver Peak, Nevada, and through purchasing lithium concentrate from its joint venture.

We are positive on its long-term investment potential, given its competitive position as a leading lithium producer and the fundamental outlook over the next decade for lithium. The Group is strategically growing its lithium and bromine capacity to leverage further its low-cost resources (20% CAGR expected through to 2025), and similarly to SQM, has "shifted its lithium contracting strategy to realise greater benefits from these strong market dynamics" according to CEO Kent Masters.

Risks to the investment case of Albemarle include weaker-than-expected lithium markets and lower prices, a slower ramp-up of lithium facilities, and unfavourable business conditions within Chile.

Supply Growth Expectations – Source: Albemarle Investor Presentation 2022

Pilbara Minerals (PLS)

The Australian lithium stock, Pilbara Minerals, is "the largest independent hard-rock lithium operation in the world, with an estimated mine life of 26+ years". Located in one of the world's premier mining jurisdictions, the Pilgangoora project is 120km from Port Headland in Western Australia's resource-rich Pilbara region. The Pilgangoora operation possesses two processing plants that produce either spodumene or tantalite concentrates.

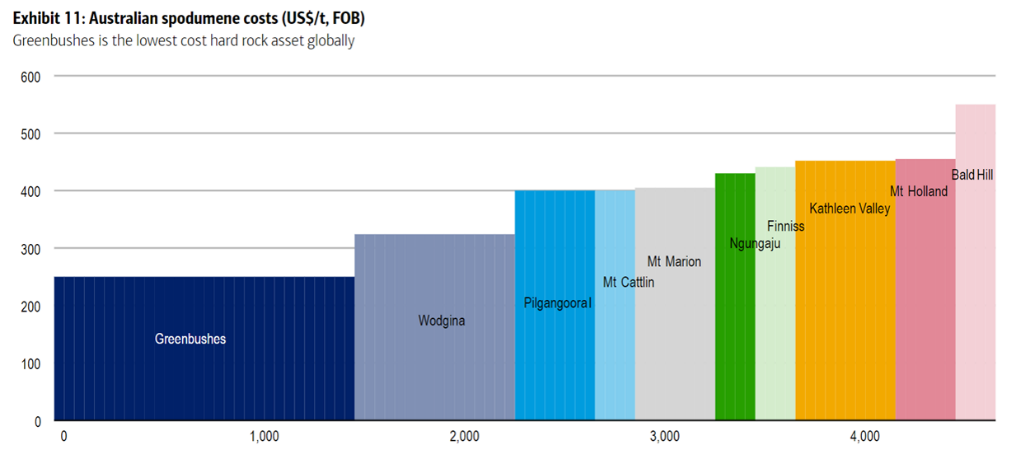

The company is the largest pure-play lithium producer on the ASX and subsequently experienced a meteoric price appreciation throughout 2022. In the short term, we believe investors should wait for a more opportune entry point from a valuation perspective. However, on a long-term view, we remain supportive of the company's fundamentals. The Group's positioning on the Australian spodumene cost curve is an element of the investment thesis over the long term. A lower positioning provides the Group more significant margin and profitability protection against volatility within the spodumene pricing environment.

Australian Spodumene Cost Curve (US$/t, FOB) – Source: BofA Global Research January 2022

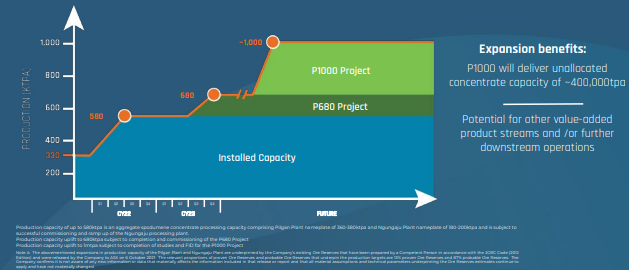

Additionally, the Group seeks to expand the Pilgan Plant's production capacity by approximately 100,000 dry metric tonnes (dmt) per annum. The ability to bring on additional capacity will benefit the company over the long term due to the expectation of prolonged market tightness and, consequently, elevated prices.

PLS Project Production Growth – Source: PLS Annual Report 2022

Important Information

All information contained in this publication is provided on a factual or general advice basis only and is not intended or be construed as an offer, solicitation, or a recommendation for any financial product unless expressly stated. All investments carry risks and past performance is no indicator of future performance. Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice. Opinions, estimates and projections constitute the current judgement of the author as at the date of this publication. Any comments, suggestions or views presented in this communication are not necessarily those of HALO Technologies, Macrovue or any of their related entities (‘we’, ‘our’, ‘us’), nor do they warrant a complete or accurate statement.

The opinions and recommendations in this publication are based on a reasonable assessment by the author who wrote the report using information provided by industry resources and generally available in the market. Employees and/or associates of HALO Technologies or any of the other related entities may hold one or more of the investments reviewed in this report. Any personal holdings by HALO Technologies or any of the other related entities employees and/or associates should not be seen as an endorsement or recommendation in any way. HALO Technologies Pty Limited ACN 623 830 866 is a Corporate Authorised Representative CAR: 001261916 of Macrovue Pty Limited ACN:600 022 679 AFSL 484264.

MacroVue Pty Limited is a wholly owned subsidiary of HALO Technologies Pty Ltd. These companies are related entities with Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).