“Markets finish a pretty good week “

Best quotes of the week:

"America rose beyond just being a country. It was like an aspiration for most of the world, and we're eroding that brand right now.” Ken Griffin

"It’s not the things you buy and sell that make you money; it’s the things you hold.” -Howard Marks

The S&P 500 rose on Friday, adding to its strong gains for the week, as investors continue to navigate an evolving global trade landscape, while major tech names got a boost.

The broad market benchmark ended 0.74% higher at 5,525.21, while the Nasdaq Composite added 1.26% to end at 17,282.94. The Dow Jones Industrial Average lagged, but managed to close 0.05%, or 20 points higher, at 40,113.50.

Alphabet rose 1.5% after the Google-parent and “Magnificent Seven” name reported a beat on the top and the bottom line for the first quarter. Tesla, meanwhile, popped 9.8%, while fellow “Magnificent Seven” names Nvidia and Meta Platforms advanced 4.6% and 2.7%, respectively. Palantir gained 4.6%.

Well, what a week that was thanks to the “Mad King’s” shifting positions on just about everything-tariffs, the Fed, China, Ukraine you name it. Still the markets managed to navigate between the Scylla of despair and the Charybdis of over optimism and finished sharply higher.

The major averages had sharp weekly gains. In USD the S&P 500 is up more than 4%, while the Nasdaq has climbed more than 6%. The Dow has underperformed but is still headed for a one-week advance of more than 2%.

This week we have Meta, Microsoft, Amazon & Apple all reporting earnings. AI capex, guidance and tariff issues will all be in focus for sure.

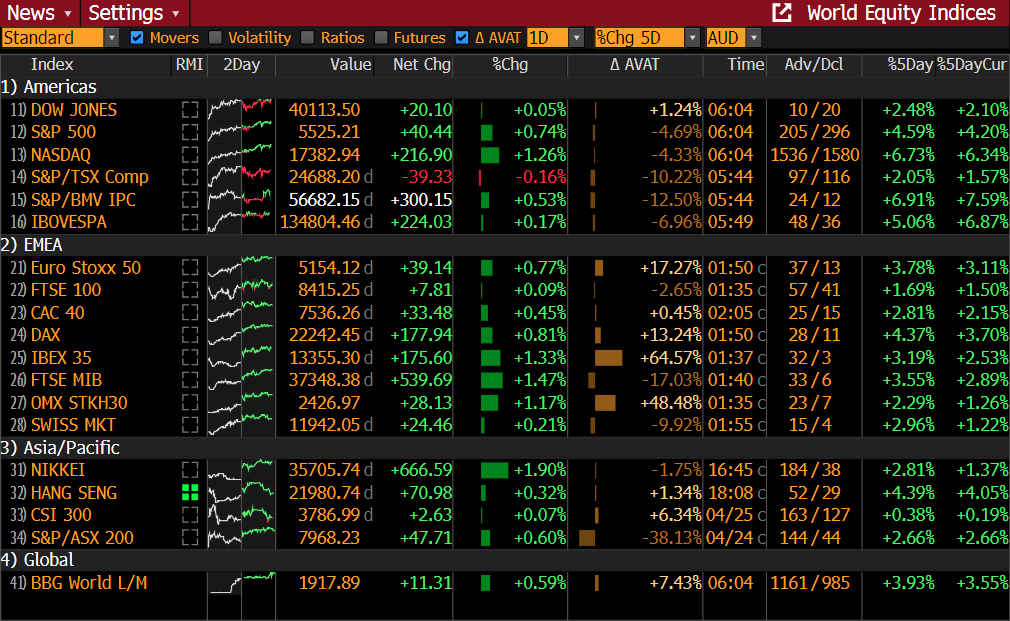

Bloomberg Global Market Matrix:

Global markets on higher on Friday and for the week. (1 Day return local currency centre columns: 5 Day local currency and AUD returns far right columns) AUD a small headwind for USD and EUR 5- day returns.

Source: Bloomberg

Market Data Friday close:

AUD at .6397 -0.18%.

The 10-year US Treasury yield is now 4.257% -0.05.

Commodities:

Oil (W.T.I.) is now trading at US$63.21 +0.67%.

Spot Gold now at US$3316.90 -0.95%.

Crypto: (Overnight in USD):

Bitcoin 94,406.07 +126.91 (+0.13%)

Ethereum 1,804.94 -3.29 (-0.18%)

Markets Department

Take from what you will but the NYSE just triggered a “SuperZweig breadth thrust”. It occurs when the indicator, which measures market breadth by analysing the ratio of advancing to declining stocks on the New York Stock Exchange (NYSE), undergoes an exceptionally rapid shift from oversold to overbought conditions within a short period, typically 10 trading days.

The S&P 500 has returned more than +20% the year following every prior thrust.

.webp)

Source: SentimenTrader

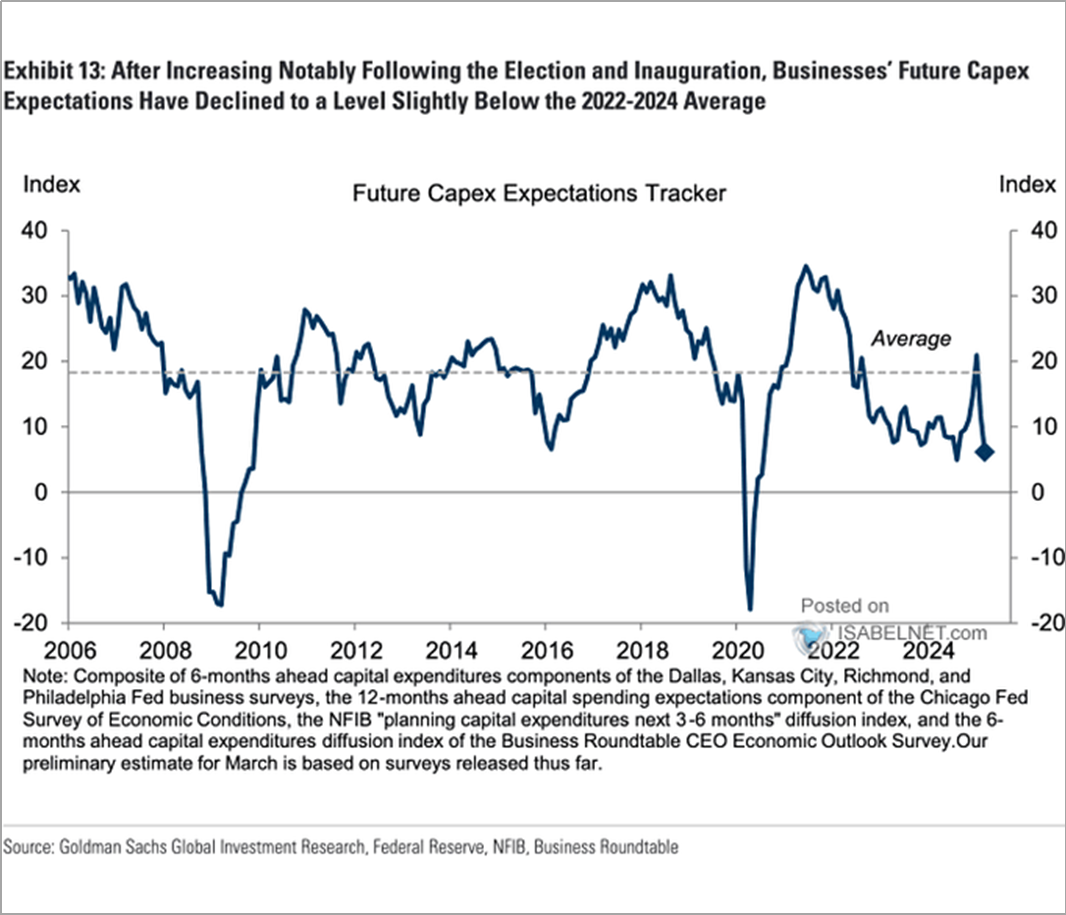

After a brief surge following the election and inauguration, businesses' future capex expectations have moderated and now sit slightly below the average levels seen from 2022 to 2024, reflecting heightened uncertainty.

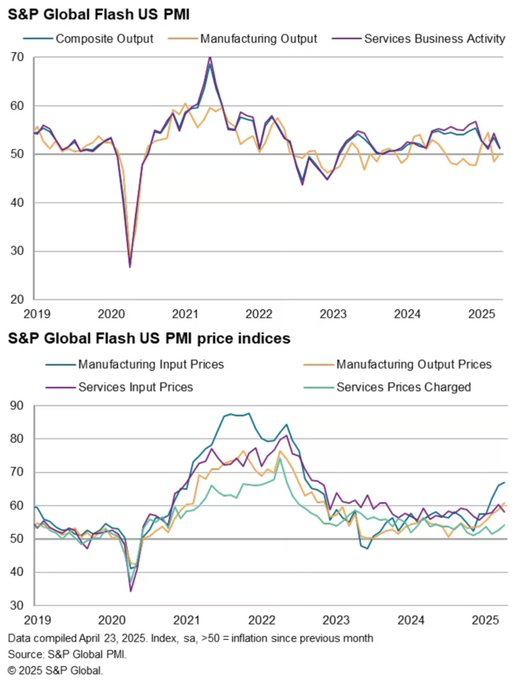

US business activity growth slowed to a 16-month low in April ... with business expectations ... also dropping to one of the lowest levels seen since the pandemic. Prices charged for goods and services meanwhile rose at the sharpest rate for just over a year. Blame it on Bozo the Evil Clown (aka you know who).

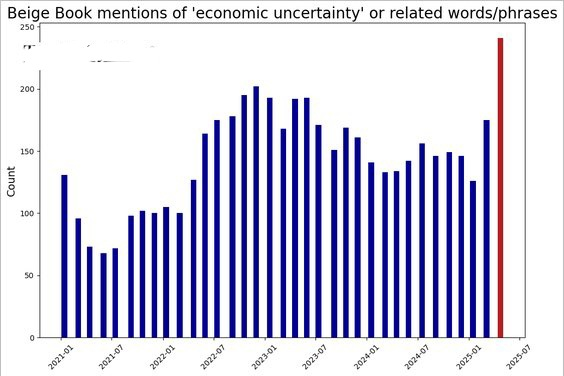

The Federal Reserve Beige Book mentions of "economic uncertainty" soaring.

Source: Federal Reserve

The US dollar's recent weakness has pushed its Relative Strength Indicator or RSI into oversold territory, suggesting a potential technical rebound. When the RSI reached similar levels in July 2023, the dollar rallied about 7% in the following months.

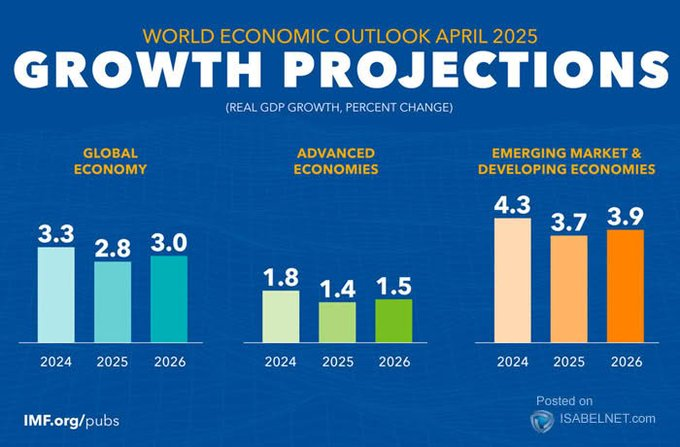

The International Monetary Fund projects global economic growth of 2.8% in 2025 and 3.0% in 2026, reflecting a subdued outlook shaped by persistent trade tensions and high policy uncertainty. Positive global numbers because (lucky for them) many countries don’t have a certifiable idiot running the country!

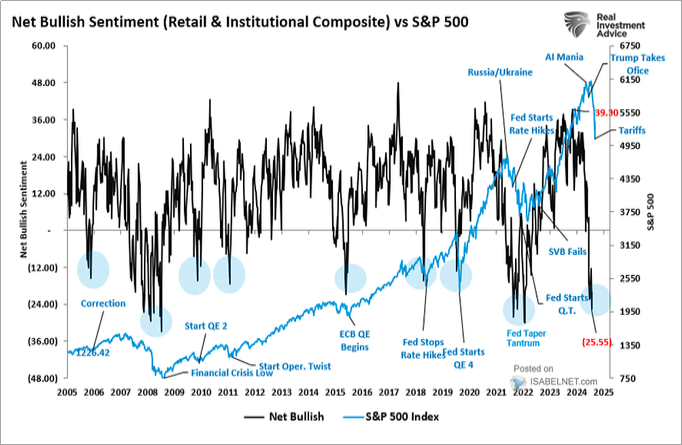

When investor sentiment reaches extremely negative levels—such as those currently observed—these conditions have historically tended to coincide with, or occur near, market bottoms.

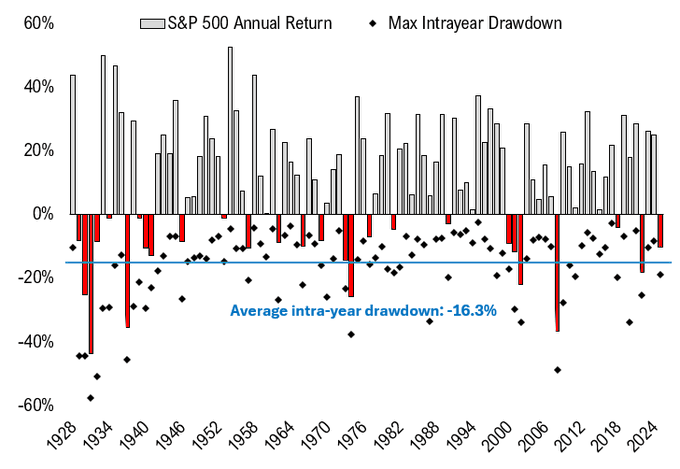

Corrections happen but 80% of the time markets are positive (grey bars)

Source: Bespoke

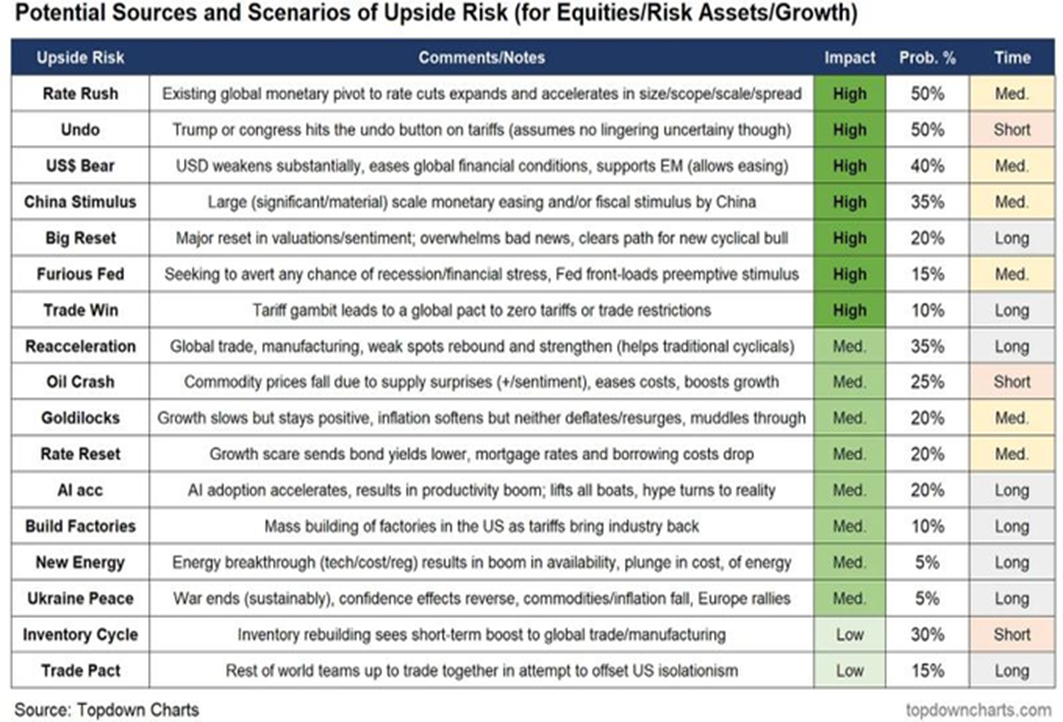

While bearishness abounds, and there are very real downside risks, it's important not to lose sight of the opposite...

"What's the best that could happen?"

Taking stock of Upside Risks.

And of course:

In part, the US stock market has been so exceptional because money has been flowing in from investors using it as a piggy bank. But there’s also a fundamental reason: US companies are more profitable by a huge amount quantitatively. May it remain so!

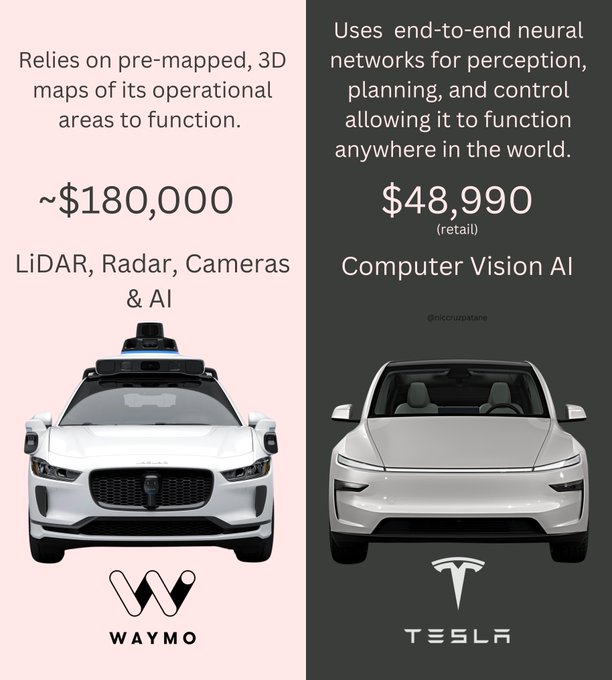

Full Self Driving is here (Waymo) but Tesla looks like the long-term winner.

Consider: US Transportation Secretary Sean Duffy announced a new framework for self-driving cars Friday afternoon, prioritizing safety, unleashing innovation, and enabling commercial deployment.

The Week Ahead:

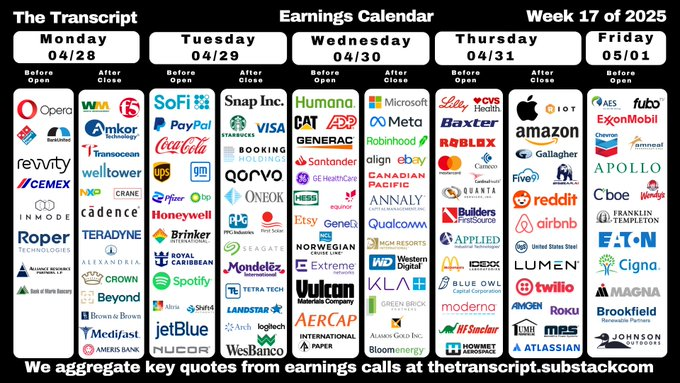

Earnings for Q1 2025 on deck this week. It’s a VERY big one. More Mag 7 names coming up.

Source: The Transcript

Halo companies reporting include PayPal, Coca Cola, Starbucks, Visa, Pfizer, BP, Honeywell, Royal Caribbean, Booking Holdings, Caterpillar, Santander, Microsoft, Meta, Qualcomm, Eli Lilly, Roblox, Mastercard, Moderna, Apple, MacDonalds, Amazon, Airbnb, Twilio, Roku, Amgen, ExxonMobil, Chevron, and Brookfield Renewables. Whew!!

Source: The Transcript

(Remember we are a day later in Australia)

U.S. Economic data to be released this week:

While it will be corporate earnings that will be the market drivers this week, the first estimate of U.S. first-quarter gross domestic product and jobs data for April will be closely watched as investors look for evidence of how much President Trump’s tariff plans have hurt the economy. Inflation data (PCE) also important.

Time (ET) Report Period Actual Median Forecast Previous

MONDAY, APRIL 28

None scheduled

TUESDAY, APRIL 29

8:30 am Advanced U.S. trade balance in goods March -- $147.8B

8:30 am Advanced retail inventories March -- 0.1%

8:30 am Advanced wholesale inventories March -- 0.3%

9:00 am S&P Case-Shiller home price index (20 cities) Feb. -- 4.7%

10:00 am Consumer confidence April 87.7 92.9

10:00 am Job openings March 7.4M 7.6M

WEDNESDAY, APRIL 30

8:15 am ADP employment April 110,000 155,000

8:30 am GDP Q1 0.4% 2.4%

8:30 am Employment cost index Q1 1% 0.9%

9:45 am Chicago Business Barometer (PMI) April 45.5 47.6

10:00 am Consumer spending March 0.5% 0.4%

8:30 am Personal income March 0.4% 0.8%

10:00 am PCE index March 0.0% 0.3%

10:00 am PCE (year-over-year) 2.2% 2.5%

10:00 am Core PCE index March 0.1% 0.4%

10:00 am Core PCE (year-over-year) 2.5% 2.8%

10:00 am Pending home sales March 1% 2%

THURSDAY, MAY 1

8:30 am Initial jobless claims 226,000 222,000

9:45 am S&P final U.S. manufacturing PMI April -- 50.7

10:00 am ISM Manufacturing April 47.8 49.0

10:00 am Construction spending March 0.3% 0.7%

TBA Auto sales April 17.2%

FRIDAY, MAY 2

8:30 am U.S. nonfarm payrolls April 130,000 228,000

8:30 am U.S. unemployment rate April 4.2% 4.2%

8:30 am U.S. hourly wages April 0.3% 0.3%

8:30 am Hourly wages year over year -- 3.8%

10:00 am Factory orders March 3.4% 0.6%

(Remember we are a day later in Australia)

Halo Technologies Corporate Earnings

Thales HO FP

Sales were €4.96 billion ($5.62 billion), up 9.9% like-for-like from Q1 2024, exceeding analyst expectations of €4.80 billion. Growth was driven by robust demand in defence and aerospace.

Order Intake was €3.78 billion, down 27% organically from Q1 2024, which included major contracts like Indonesia’s Rafale jet deal. This was below analyst forecasts of €4.86 billion.

Thales reported lower orders that came below analysts' expectations for the first quarter, a decline the company attributed to a high comparison base a year earlier, when it booked hefty defence contracts.

2025 Outlook: Thales reaffirmed its full-year targets, projecting 5-7% like-for-like sales growth (revenues of €21.7-21.9 billion) and an adjusted operating margin of 12.2-12.4%.

According to the company Defence, which accounts for over half of revenue, remains largely unaffected by global trade tariffs. Thales is exploring measures like customer surcharging to mitigate tariff impacts on non-defence segments.

Thales saw strong growth in both mature and emerging markets, with aerospace benefiting from sustained avionics demand. The space segment performed well in orders despite a high comparison base.

The company also highlighted its resilience amid geopolitical tensions and tariff concerns, with defence demand supported by increased European military spending. No profit figures were reported for Q1, as is standard for Thales’ first-quarter updates.

The company said Thursday that it bagged big contracts for work on Dassault Aviation's Rafale fighter jets and an air-surveillance system for a military customer in the Middle East in the first quarter of last year, lifting the comparison base with this year's first quarter.

The company said its forecasts exclude new macroeconomic and geopolitical disruption and any new tariffs.

Thales is held in the “Defence and Aerospace” thematic portfolio or “Vue”

Level3 Harris LHX

L3 Harris Technologies (LHX) reported Q1 non-GAAP earnings Thursday of $2.41 per diluted share, up from $2.25 a year earlier.

Analysts polled by FactSet expected $2.31.

Revenue for the quarter ended March 29 was $5.13 billion, down from $5.21 billion a year earlier. Analysts surveyed by FactSet expected $5.20 billion.

The company lowered its 2025 non-GAAP EPS outlook to between $10.30 and $10.50 from a prior range of $10.55 to $10.85. Analysts polled by FactSet expect $10.63.

L3Harris Technologies now expects 2025 revenue of $21.4 billion to $21.7 billion versus a prior projection of $21.8 billion to $22.2 billion. Analysts surveyed by FactSet expect $21.90 billion.

"We’re building on our momentum with a strong start to the year, driven by solid operational execution and program performance, leading to continued expansion in adjusted segment operating margin. We continue to see demand for our solutions, reflecting our alignment with key national security priorities. Our capital deployment strategy remains clear, returning nearly $800 million in the quarter to shareholders through dividends and share repurchases, and increasing our dividend for the 24th consecutive year. As we work toward our 2026 financial framework, we remain confident in our ability to meet our targets and drive long-term, profitable growth,” said Christopher E. Kubasik, Chair and CEO.

Kubasik added, “We are well-positioned to support the new administration's evolving defense priorities, with strategic partnerships at the core of our Trusted Disruptor strategy. Our partners recognize our speed and agility and together we are focused on rapidly delivering mission-critical solutions for our customers. Based on our first quarter performance and the completion of the Commercial Aviation Solutions divestiture, we are updating our guidance while reaffirming our free cash flow commitment

Level3 Harris is held in the “Defence and Aerospace” thematic portfolio or “Vue”

Mobileye MBLY

Mobileye Global (MBLY) reported fiscal Q1 adjusted earnings Thursday of $0.08 per diluted share, swinging from an adjusted loss of $0.07 per share a year earlier.

Analysts polled by FactSet expected adjusted EPS of $0.08.

Revenue for the quarter ended March 29 was $438 million, compared with $239 million a year earlier.

Analysts polled by FactSet expected $434.9 million.

The company said it expects fiscal Q2 revenue growth of about 7% year over year.

Mobileye Global reiterated its fiscal 2025 revenue guidance range of $1.69 billion to $1.81 billion. Analysts polled by FactSet expect $1.74 billion.

“Based on strong revenue trends to-date and our own analysis of likely production impacts of the current tariff conditions (including the most recent third-party forecasts), we continue to expect to deliver revenue and profitability within the guidance range. While uncertainty has clearly risen, our original outlook was designed to account for some amount of macro deterioration in 2025,” said Mobileye President and CEO Professor Amnon Shashua.

“Business development activity was strong in Q1. In fact, Q1 was one of the largest quarters on record in terms of projected future volumes from design wins. Among other important wins, notable achievements were an ADAS design win with a customer we haven’t had since 2016, our first Surround ADAS design win with Volkswagen Group, and acceleration for our Mobileye Drive robotaxi solution.”

Mobileye is held in the “Car of the Future” thematic portfolio or “Vue”.

Merck MRK

Merck's first-quarter net income increased as sales of its Keytruda cancer drug rose, but the Big Pharma company cut its 2025 adjusted earnings projection, partly to account for recently imposed tariffs.

The company posted first-quarter earnings of $5.08 billion, or $2.01 a share, up from $4.76 billion, or $1.87 a share, a year earlier.

Stripping out certain one-time items, earnings came in at $2.22 a share, surpassing the average Wall Street target of $2.14 a share, as per FactSet.

Sales fell 2% to $15.53 billion, but still topped the average analyst forecast of $15.36 billion, as tallied by FactSet.

Pharmaceutical sales decreased 3% to $13.64 billion, weighed down by declines in vaccines, virology and immunology that were partially offset by growth in oncology, cardiology and diabetes. Revenue for the company's cancer immunotherapy, Keytruda, rose 4% to $7.21 billion, while human papillomavirus vaccine Gardasil slumped 41% to $1.33 billion, mainly due to lower demand in China. Sales of Januvia climbed 19% to $796 million, buoyed by higher prices in the US, although demand in most international markets fell amid generic competition.

Winrevair, Merck's new treatment for pulmonary arterial hypertension, or PAH, brought in $280 million in sales, blowing away estimates for $243 million. PAH is a condition that causes high blood pressure in the lungs. Merck added 1,400 new patients in the quarter. The company is also studying Winrevair in patients with other types of heart disease.

Animal health revenue increased 5% to $1.59 billion. The result was mainly strengthened by higher demand for livestock products, where sales rose 9%, as well as revenue contribution from the Elanco aqua business acquired in July 2024, according to the company

Merck cut its 2025 adjusted earnings projection to a range between $8.82 and $8.97 a share from a previous estimate of $8.88 to $9.03 a share. The new guidance includes a charge of roughly $200 million, or about 6 cents a share, related to a payment on a license agreement with Hengrui Pharma.

Merck's projection also includes an estimated $200 million in costs due to tariffs implemented to date.

Merck reiterated its previous forecast for 2025 sales of $64.1 billion to $65.5 billion.

Merck is held in the “Big Pharma” thematic portfolio or “Vue”

Bristol Myers BMY

Bristol-Myers Squibb (BMY) reported Q1 non-GAAP earnings Thursday of $1.80 per diluted share, compared with a loss of $4.40 a year earlier.

Analysts polled by FactSet expected $1.49.

Revenue for the quarter ended March 31 was $11.2 billion, down from $11.87 billion a year earlier.

Analysts surveyed by FactSet expected $10.7 billion.

The first quarter saw strong performances from the blood thinner Eliquis and cancer treatment Revlimid, a pair of older medicines whose sales are expected to dramatically decline before the end of the decade. Bristol also had a foreign exchange benefit of about $500 million in the period that contributed to sales coming in ahead of estimates.

Most important among the new drugs is Cobenfy, a schizophrenia treatment that Bristol says has the potential to treat an array of neurological diseases. Earlier this week, the drug failed to beat a placebo in a study that would have supported expanding its use. Chief Commercial Officer Adam Lenkowsky said he’s still confident in its multibillion-dollar potential.

“Schizophrenia is only the beginning,” Lenkowsky said in an interview. “We know the work we need to do to maximize this launch, and we plan to make this a very big product for the company over time.”

Cobenfy sales were $27 million in the first three months of the year, its first full quarter on the market. Another key new medicine, the heart drug Camzyos, trailed analyst estimates with $157 million in sales. Last week, Bristol said Camzyos missed its goal in a trial designed to broaden its approved indications. Win a few lose a few.

The company said it increased its full-year 2025 non-GAAP earnings guidance to $6.70-$7.00 per share from $6.55-$6.85. Analysts surveyed by FactSet expect $6.74.

The company increased it full-year 2025 revenue guidance to about $45.8 billion-$46.8 billion from $45.5 billion. Analysts polled by FactSet expect $45.7 billion.

That’s a big positive.

“Our strong execution in the first quarter drove continued momentum across our Growth Portfolio and meaningful progress in the pipeline,” said Christopher Boerner, Ph.D., board chair and chief executive officer, Bristol Myers Squibb. “We are advancing our multi-year plan to become a more agile and efficient company, while strengthening the foundation for top-tier, long-term growth. Our strategy is clear, and our actions are accelerating the delivery of transformational medicines to patients."

Bristol Myers is held in the “Big Pharma” thematic portfolio or “Vue”

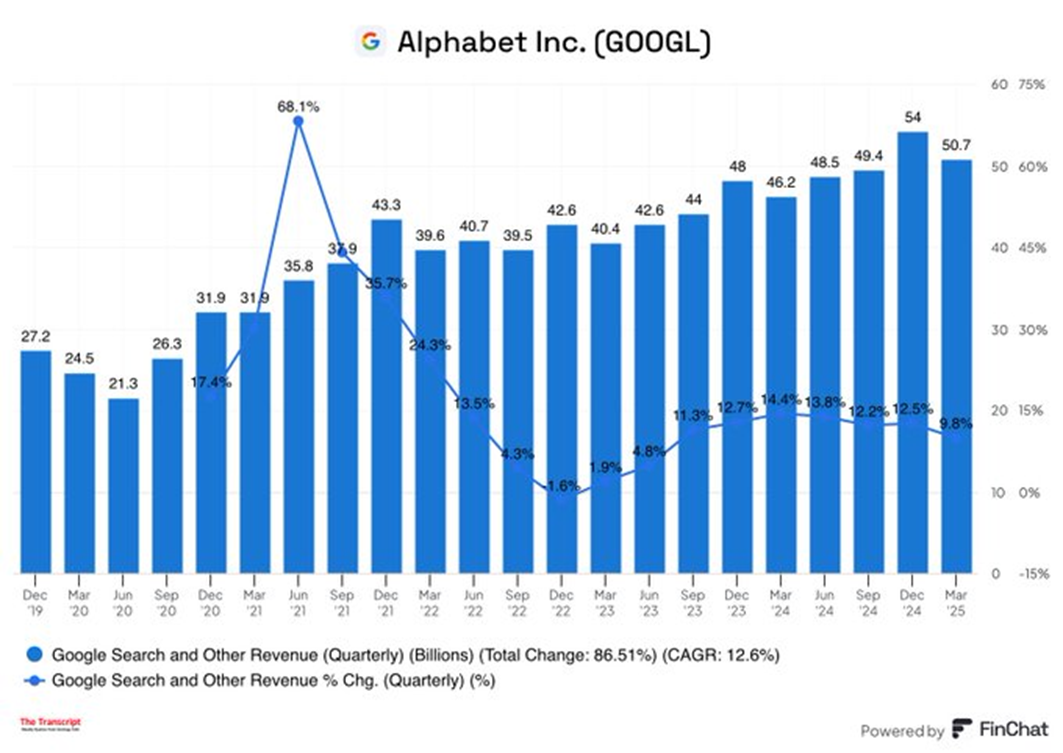

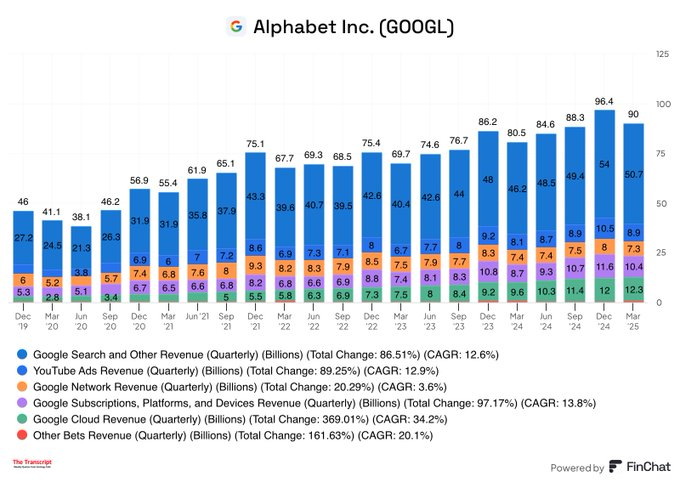

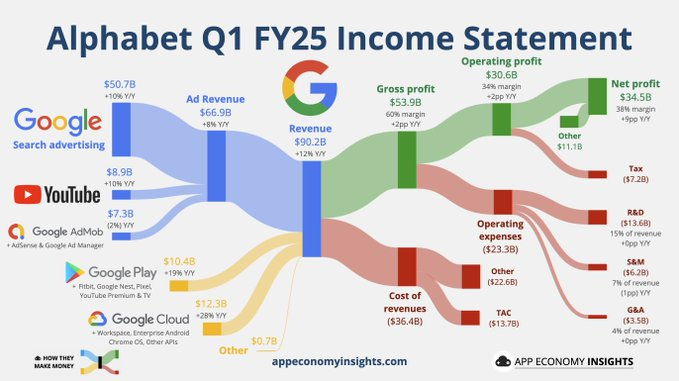

Alphabet GOOGL

Google parent Alphabet delivered first quarter earnings and revenue that topped consensus estimates as internet search advertising growth beat expectations.

Reported after the market close on Friday, Google earnings for the quarter ending March 31 surged 48% to $2.81 per share. The tech giant reports Google earnings under generally accepted accounting principles, also known as GAAP.

In Q1, Google's gross revenue rose 12% to $90.2 billion amid headwinds from currency exchange rates and a weaker U.S. dollar.

Analysts polled by FactSet had projected EPS of only $2.01 on revenue of $89.2 billion. That’s a huge earnings beat.

Also, Google's Q4 internet search-advertising revenue came in at $50.7 billion, up 10%, versus estimates of $50.4 billion.

Further, Google said cloud-computing revenue rose 28% to $12.26 billion, in-line with estimates.

Meanwhile, YouTube ad revenue climbed 10.3% to 8.93 billion, slightly missing estimates of $8.97 billion. Still pretty close.

Sundar Pichai, CEO, said: "We're pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI. This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation. Search saw continued strong growth, boosted by the engagement we're seeing with features like AI Overviews, which now has 1.5 billion users per month. Driven by YouTube and Google One, we surpassed 270 million paid subscriptions. And Cloud grew rapidly with significant demand for our solutions."

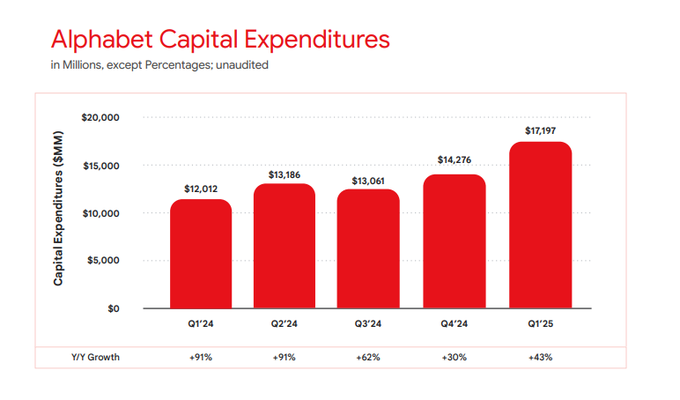

Q1 Capex Grew 43% YoY to 17.2B. Alphabet CFO: "...we still expect to invest approximately $75 billion in Capex this year”

The AI trade is intact. Street is at $72B. Positive sign for AI investment outlook.

Source: Company Reports

Segment Summary:

Source: Company Reports

Source: App Economy

A solid report all around. Shares of Alphabet were trading roughly 5% higher in the after-hours session following the company's earnings beat.

Alphabet is held in numerous Halo thematic portfolios or “Vues”-“Tech Stars”, “Social Media”, “Artificial Intelligence”, “Perennial Millennials” and “Disruptive Technologies”.

Safran SAF

Safran SA on Friday reported strong first-quarter revenue growth and reaffirmed its 2025 guidance while noting it is taking steps to limit the potential economic impact of newly introduced trade tariffs.

The Paris-based aerospace and defence company said adjusted revenue rose 17% annually to EUR7.26 billion in the three months to March 31, driven by strength in civil aftermarket services, defence, and aircraft interiors.

First-quarter consolidated revenue was EUR7.38 billion.

Chief Executive Officer Olivier Andries said the group "kicked off the year on a strong note across all businesses," but acknowledged ongoing uncertainty around tariffs. "Safran is actively working to mitigate the economic impact from tariffs," he said, citing efforts to adapt supply flows and engage with customers.

The propulsion division posted 17% organic revenue growth, with spare parts sales for civil engines climbing 25% and services up 18%. While deliveries of LEAP engines fell to 319 from 367, the lower volume was offset by a more favourable customer mix.

Equipment and defence revenue rose 11% organically, helped by nacelles, landing systems, avionics, and higher volumes in defence and space systems. Aircraft interiors revenue increased 13.8% on strong aftermarket demand and a nearly threefold rise in business class seat deliveries.

Safran confirmed its 2025 guidance, excluding any potential impact of tariffs. It expects around 10% revenue growth, recurring operating income between EUR4.8 billion and EUR4.9 billion, and free cash flow between EUR3.0 billion and EUR3.2 billion.

The company is applying for exemptions under the USMCA trade agreement and using free trade zones and bonded warehouses to limit tariff-related disruption, it said.

Safran is held in the “Defence and Aerospace” thematic portfolio or “Vue”.

AbbVie ABBV

For the first quarter, adjusted EPS was $2.46 from sales of $13.3 billion. The consensus call among analysts tracked by FactSet was for EPS of $2.38 on sales of $12.9 billion.

Revenue from its immunology portfolio rose 17% from the same period a year ago to $6.3 billion.

Declining sales of Humira, a drug for rheumatoid arthritis and other immune disorders, were offset by sales of newer immunology drugs Skyrizi and Rinvoq, which rose 71% and 57%, respectively. Humira revenue was $1.1 billion in the quarter, falling 50% from a year earlier as a result of competition from generic drugs.

AbbVie raised its forecast for full-year profit by 10 cents, with one huge caveat. It said it now expects adjusted earnings per share of between $12.09 and $12.29 for 2025, excluding the effects of shifts in U.S. trade policy, including tariffs on pharmaceuticals, that could affect its business.

"AbbVie's first-quarter results were well ahead of our expectations and reflect an excellent start to the year," said Robert A. Michael, chief executive officer, AbbVie. "The fundamentals of our business are strong and we continue to bolster our outlook with pipeline advancements and strategic investments. Based on the progress we are making, AbbVie is well positioned for the long term."

AbbVie stock rose 2.1% to $184.33 in early trading, while the S&P 500 rose marginally.

AbbVie is held in the “Big Pharma” thematic portfolio or “Vue”.

Schlumberger SLB

Schlumberger (SLB) reported Q1 earnings Friday of $0.72 per diluted share, down from $0.75 a year earlier.

Analysts polled by FactSet expected $0.73.

Revenue for the quarter ended March 31 was $8.49 billion, down from $8.71 billion a year earlier.

“First-quarter adjusted EBITDA margin was slightly up year on year despite softer revenue as we continued to navigate the evolving market dynamics,” said SLB Chief Executive Officer, Olivier Le Peuch.

“It was a subdued start to the year as revenue declined 3% year on year. Higher activity in parts of the Middle East, North Africa, Argentina and offshore U.S., along with strong growth in our data center infrastructure solutions and digital businesses in North America, were more than offset by a sharper-than-expected slowdown in Mexico, a slow start to the year in Saudi Arabia and offshore Africa, and steep decline in Russia.

“The expansion of our accretive margin digital business and the strength of our Production Systems division, combined with our cost reduction initiatives, have driven another consecutive quarter of year-on-year adjusted EBITDA margin growth.

“These results demonstrate SLB's resilience in changing market conditions. We are continuously exercising cost discipline and aligning our resources with activity levels, leveraging our global reach and industry-leading innovation capabilities, expanding our differentiated digital offerings, and strategically diversifying the portfolio beyond oil and gas,” Le Peuch said.

Schlumberger is held in the “Big Oil” thematic portfolio or “Vue”.

Comcast Corp (CMCSA)

Comcast reported Q1 adjusted EBITDA of $9.53B vs consensus $9.12B (beat by 4.5%) and $9.36B a year ago.

Adjusted EPS increased 4.5% y/y to $1.09 vs consensus $0.99 (beat by 10.1%).

Revenue was flat y/y at $29.89B vs consensus $29.77B (beat by 0.4%).

Connectivity & Platforms:

• Revenue for Connectivity & Platforms was consistent with the prior year period. Adjusted EBITDA increased due to growth in both Residential Connectivity & Platforms Adjusted EBITDA and Business Services Adjusted EBITDA. Adjusted EBITDA margin increased to 41.4%.

• Total Customer Relationships for Connectivity & Platforms decreased by 228,000 to 51.4 million, primarily reflecting decreases in Residential Connectivity & Platforms customer relationships. Total domestic broadband customer net losses were 199,000, total domestic wireless line net additions were 323,000 and total domestic video customer net losses were 427,000.

Content & Experiences:

• Revenue for Content & Experiences was consistent compared to the prior year period at $10.46B vs consensus $10.27B (beat by 1.8%), primarily reflecting an increase in Studios (higher content licensing) and Media (higher international networks), offset by a decrease in Theme Parks (lower revenue at domestic theme parks partially due to the Hollywood wildfires).

• Adjusted EBITDA for Content & Experiences was consistent compared to the prior year period primarily due to a decline in Theme Parks, offset by growth in Media and Studios.

“We had strong financial results in the first quarter, growing Adjusted EPS mid-single digits and generating $5.4 billion of free cash flow while investing in our six growth businesses and returning $3.2 billion to shareholders," said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation. "Our connectivity businesses generated 4% revenue growth, fueling expansion in C&P EBITDA margins to 41.4%. We also achieved our highest wireless line additions in two years and have outperformed in Business Services with mid-single digit revenue and EBITDA growth and margins of roughly 57%. At the same time, momentum in streaming continues with 21% growth in Media EBITDA; and Theme Parks remain on an incredible growth trajectory. We could not be more excited for the grand opening of Epic Universe in Orlando next month and our plans to bring a new world-class theme park to the UK. With our significant free cash flow generation, disciplined approach to capital allocation and the strength of our diversified businesses, I am confident that we are well-positioned to navigate an evolving environment and capture future opportunities."

Operating Metrics:

• Broadband Net Adds: (199K) vs consensus (146.3K)

• Wireless Net Adds: +323K vs consensus +296.6K

• Peacock Paid Subscribers: 41M vs consensus 37.21M (+13.9% q/q)

• Passings: 63.97M vs consensus 63.94M

• Residential Relationships: 30.97M vs consensus 31.06M

• Total Wireless Lines: 8.15M vs consensus 8.12M

Capital Expenditures decreased 14.4% to $2.3 billion. Connectivity & Platforms’ capital expenditures decreased 13.8% to $1.6 billion, primarily reflecting lower spending on customer premise equipment and scalable infrastructure. Content & Experiences' capital expenditures decreased 10.8% to $602 million, as we near completion of the construction of Epic Universe theme park in Orlando, which is scheduled to open on May 22, 2025.

Net Cash Provided by Operating Activities was $8.3 billion. Free Cash Flow was $5.4 billion vs consensus $3.96B (beat by 36.9%).

Dividends and Share Repurchases. Comcast paid dividends totaling $1.2 billion and repurchased 56.2 million of its shares for $2.0 billion, resulting in a total return of capital to shareholders of $3.2 billion.

Comcast shares traded slightly lower largely due to disappointing Broadband net adds despite a generally solid report.

Comcast Corp (CMCSA) is held in Halo Technologies “Entertainment” thematic portfolio.

Tractor Supply TSCO

Tractor Supply reported Q1 EPS of $0.34 vs consensus $0.37 (missed by 8.1%) and $0.37 a year ago.

Operating Income decreased 5.3% to $249.1M vs consensus $269.5M (missed by 7.6%).

Net sales for the first quarter of 2025 increased 2.1% to $3.47 billion vs consensus $3.53B (missed by 1.7%) from $3.39 billion in the first quarter of 2024. The increase in net sales was driven by new store openings and the contribution from Allivet, partially offset by a decrease in comparable store sales.

Comparable store sales decreased 0.9% vs consensus +0.8%, as compared to an increase of 1.1% in the prior year’s first quarter. The strong growth in comparable average transaction count increase of 2.1% was offset by a comparable average ticket decline of 2.9%. Comparable average transaction growth reflects strength in year-round categories including consumable, usable and edible products and winter seasonal merchandise. This growth was offset by declines in spring seasonal goods including related big ticket categories.

The Company opened 15 new Tractor Supply stores and two new Petsense by Tractor Supply stores and closed two Petsense by Tractor Supply stores in the first quarter of 2025.

“In 2024, our business performed well in a challenging retail environment, and we made significant progress on our Life Out Here strategy. We achieved numerous milestones during the year, including having about half of our stores in the Project Fusion layout and opening our 10th and largest distribution center. The fundamentals of our business remain strong with ongoing market share gains, record Neighbor’s Club members, digital sales in excess of one billion dollars and high-return new store openings. I extend my sincere gratitude to the more than 50,000 Team Members for their steadfast dedication to upholding our Mission and Values and supporting their communities,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

“We enter the back half of the decade with momentum and opportunity. Our existing initiatives are creating value and have continued runway for growth. Our recently announced Life Out Here 2030 strategy represents significant opportunities to continue to gain market share in a growing total addressable market. Our acquisition of Allivet, a leading online pet pharmacy, is a great example of unlocking new opportunities for growth. We expect our 2025 comparable store sales to improve throughout the year as the macro headwinds impacting our business abate. We remain excited about our bright future and are committed to delivering sustained long-term value creation for our shareholders," said Lawton.

Gross margin increased 25 basis points to 36.2% vs consensus 36.3% (missed by 10 bps) and 36.0% in the prior year’s first quarter. The gross margin rate increase was primarily attributable to disciplined product cost management and the continued execution of an everyday low price strategy.

As a percentage of net sales, SG&A expenses increased 81 basis points to 29.0% from 28.2% in the first quarter of 2024, primarily attributable to planned growth investments, which included higher depreciation and amortization and the operations of the Company’s 10th distribution center, and deleverage of fixed costs given the comparable store sales decline.

Operating Margin decreased 56bps to 7.2% vs consensus 7.6% (missed by 40 bps).

Inventories grew +5.4% y/y to $3.21B.

Management cited increased uncertainty, particularly due to newly introduced tariffs, as the driver for a more cautious outlook revision.

FY 2025 Guidance (Updated):

• EPS: $2.00–2.18 vs prior $2.10–2.22 and consensus $2.16 (midpoint $2.09, missed by 3.2%).

• Revenue Growth: +4% to +8% vs prior +5% to +7% and consensus +5.4%.

• Comps: 0% to +4% vs prior +1% to +3% and consensus +1.9%.

• Operating Margin: 9.5% to 9.9% vs prior 9.6% to 10.0% and consensus 9.8%.

Q2 2025 Guidance:

• EPS: $0.79–0.81 vs consensus $0.84 (midpoint $0.80, missed by 4.8%).

• Revenue Growth: +3–4% y/y vs consensus +5.3%.

• Comps: Flat to +1% vs consensus +1.6%.

Tractor Supply is held in Halo Technologies “US High Conviction Growth Model” Portfolio.

Ming Yang Smart Energy Group Limited - 601615

Mingyang Smart Energy reported resilient 2024 full-year and strong 2025 Q1 results.

In 2024, Mingyang Smart Energy achieved revenue of RMB 27.158 billion and net profit attributable to shareholders of RMB 346 million. Revenue from the company’s new energy power generation segment reached RMB 1.729 billion. In the first quarter of 2025, growth further accelerated, with revenue rising 51.78% year-over-year to RMB 7.704 billion and net profit reaching RMB 302 million. Wind turbine sales volume grew 11.66% YoY, and the company secured 27.11 GW of new orders. Overseas revenue surged by 535.84%, demonstrating the effectiveness of its global expansion strategy.

Mingyang has firmly established itself as a global leader in offshore wind, holding the top position in China's offshore wind market with a 31.3% share. The company launched the world's largest 16.6MW floating wind platform, the "Mingyang Tiancheng," winning international accolades such as the Wind Power Monthly Gold Award. In 2024, Mingyang garnered three global gold awards for "Best Wind Turbine" and multiple other international recognitions, reflecting strong global acceptance of its wind products.

Innovative projects like the "Mingyu No.1" integrated offshore wind and aquaculture platform at the Yangjiang Qingzhou IV site demonstrate the company's leadership in deep-sea "green energy + aquaculture" synergies. Mingyang’s product range now covers offshore turbines from 5.5MW to 25MW, forming a comprehensive technology matrix.

Leveraging its in-house R&D capabilities, Mingyang Smart Energy has expanded into over 10 international markets:

• Europe: Partnered with BASF for a China-Germany offshore wind project, gaining first market entry into Europe.

• Northeast Asia: Secured local agreements in South Korea and achieved seismic resistance certification (7.6 magnitude) for projects in Japan.

• Southeast Asia: Established strategic partnerships in offshore wind and green hydrogen with AP Power in the Philippines.

• Technology Export: Its self-developed floating platforms have won global certifications, including the World Green Design Award.

Building an Integrated "Wind-Solar-Storage-Hydrogen-Fuel" Energy Ecosystem, Mingyang is constructing a multidimensional zero-carbon energy matrix:

• Solar Innovation: Launched four HJT high-efficiency solar modules certified by TÜV Nord, suitable for desert and rooftop applications.

• Energy Storage: Introduced the world's first 35kV high-voltage cascade storage system, with GWh-level capacity, addressing grid balancing challenges in Northern China.

• Hydrogen Energy: Developed the "Jupiter-1," a 30MW pure-hydrogen gas turbine capable of absorbing excess renewable energy at the million-ton scale.

• Scenario Innovation: Created solutions like "Electricity-Hydrogen-Ammonia-Methanol" cross-seasonal storage and "Hydrogen Heating Parks," with demonstration projects in Inner Mongolia.

According to the Global Wind Energy Council (GWEC), global wind power capacity is expected to grow at a 9.4% CAGR from 2023 to 2028, with offshore wind capacity expected to grow at an even faster 27.5% CAGR. Mingyang Smart Energy is strategically aligned along three major directions:

• Large Offshore Wind Strategy: Advancing floating technology R&D and mass production of 15MW+ ultra-large turbines.

• Desert Renewable Energy Development: Promoting "green hydrogen production and hydrogen-based power generation" in desert environments.

• Smart Energy Ecosystem: Accelerating asset securitization of power station projects through a "rolling development" model; 2024 power station sales revenue grew 34.21%.

With integrated advantages across "R&D–Manufacturing–Scenario Application," Mingyang is transforming from an equipment manufacturer into a smart energy solution provider.

Ming Yang Smart Energy Group Limited - is held in Halo Technologies “Carbon Neutrality and Energy Security” thematic portfolio.

Sinopharm (1099)

Sinopharm released its 2024 FY annual report and Q1 sales number.

Full year 2024 revenue was RMB584B vs RMB596.6B a year ago. Diluted EPS was RMB2.26 vs RMB2.9 last year.

The Group focused on optimizing the business model, enhancing the efficiency of resource allocation, improving operational compliance control, and promoting the effective improvement of operating quality. Meanwhile, the Group made efforts on improving its business governance capability and tapping its business development potential, laying a solid foundation for its medium- and long-term compliance and steady development.

During the Reporting Period, the Group recorded a revenue of RMB584,507.93 million, representing a decrease of 2.02% as compared with RMB596,569.57 million for the twelve months ended 31 December 2023, which was primarily due to the decrease in revenue from the Group’s medical device distribution business and other business segments.

• Pharmaceutical distribution segment: during the Reporting Period, the revenue from pharmaceutical distribution of the Group was RMB444,364.61 million, which accounted for 73.16% of the total revenue of the Group and represented an increase of 0.75% as compared with RMB441,050.70 million for the twelve months ended 31 December 2023. Such increase was mainly due to the increase in the distribution scale and the growth of the acquisition rate of the varieties involved in volume-based procurement.

• Medical device distribution segment: during the Reporting Period, the revenue from medical device distribution of the Group was RMB117,915.14 million, which accounted for 19.41% of the total revenue of the Group and represented a decrease of 9.44% as compared with RMB130,212.94 million for the twelve months ended 31 December 2023. The decrease was mainly due to the decline of sales revenue of medical devices categories with higher gross profit and the stable growth of revenue of medial consumables affected by changes in the structure of terminal demand.

• Retail pharmacy segment: during the Reporting Period, the revenue from retail pharmacy of the Group was RMB35,981.26 million, which accounted for 5.92% of the total revenue of the Group and represented an increase of 0.82% as compared with RMB35,689.38 million for the twelve months ended 31 December 2023. The increase was primarily due to the increase in prescription drug sales and the expansion of the specialty pharmacy system of the Group.

• Other business segments: during the Reporting Period, the revenue from other business of the Group was RMB9,106.49 million, representing a decrease of 12.32% as compared with RMB10,385.63 million for the twelve months ended 31 December 2023. The decrease was primarily due to the decrease in industrial product revenue.

Gross margin declined by 56bps to 7.57%. Operating margin decreased by 62bps to 2.77%.

The Group’s net cash generated from operating activities amounted to RMB11,546.01 million, representing a decrease of RMB5,627.02 million from RMB17,173.03 million for the twelve months ended 31 December 2023. Cash and Cash equivalents at the end of the year were RMB54.3B vs RMB63.8B a year ago.

For the first quarter of 2025, the company's operating revenue was approximately 12.713 billion yuan, representing a year-on-year increase of 4.87%. The net profit attributable to shareholders of the listed company was approximately 459 million yuan, showing a slight year-on-year decrease of 0.1%.

Sinopharm (1099) is held in HALO Technologies “Big Pharma” thematic portfolio.

Shanghai Junshi Biosciences Co Ltd (1877.HK)

Shanghai Junshi Biosciences Co., Ltd. (688180.SH) reported a solid set of results for the first quarter of 2025. The company achieved revenue of RMB 501 million, representing a robust 31.46% year-over-year growth. Net loss attributable to shareholders narrowed to RMB 235 million from RMB 283 million in the same period last year, despite a 26.89% year-over-year increase in R&D expenses to RMB 351 million. This reflects improving operational leverage as Junshi's commercial business scales. As of the end of the first quarter, Junshi maintained a strong liquidity position with RMB 3.022 billion in cash and short-term financial assets, providing ample resources to support its high-potential pipeline development.

The company’s core product, Toripalimab (拓益®), continued to perform strongly, generating domestic sales of RMB 447 million, a 45.72% year-over-year increase. Other commercialized products also contributed to the revenue base, including Hydrobromide Deuremidevir Tablets (民得维®) for antiviral therapy, Adalimumab (君迈康®) for autoimmune diseases, and Angoresib Antibody (君适达®) targeting oncology indications.

In terms of pipeline progress, Junshi is advancing multiple late-stage assets, notably the anti-BTLA monoclonal antibody Cemalimab (TAB004/JS004), the anti-IL-17A monoclonal antibody JS005, and the PD-1/VEGF bispecific antibody JS207. Early-stage development is also robust, with promising candidates such as the Claudin18.2-targeted ADC (JS107), the PI3K-α oral inhibitor (JS105), the CD20/CD3 bispecific antibody (JS203), and the DKK1 monoclonal antibody (JS015) under active research. The company plans to advance several of these assets into pivotal registrational trials during 2025.

A key milestone for Junshi in the first quarter was the clinical approval of JS212, an EGFR/HER3 bispecific ADC, marking the company’s first bispecific ADC to enter clinical trials and positioning it among the global leaders in this emerging field. Junshi's innovation will also be prominently showcased at the 2025 AACR Annual Meeting from April 25–30, where multiple early-stage assets—including JS015, JS107, and JS203—will be featured through late-breaking presentations, oral sessions, and posters, further highlighting the company’s growing scientific reputation.

Looking ahead, Junshi Biosciences is firmly focused on accelerating its pipeline toward commercialization, supported by its strong cash reserves. Management remains committed to expanding Junshi’s position as a global innovator across oncology, autoimmune, and infectious disease therapeutic areas. The momentum seen in 1Q25 underpins confidence in the company’s long-term strategy of balancing commercialization growth with sustained investment in next-generation innovation.

Shanghai Junshi Biosciences Co Ltd (1877) is held in Halo Technologies “Asian Healthcare” thematic portfolio.

HCA Healthcare (HCA)

HCA reported Q1 adjusted EBITDA of $3.73B vs consensus $3.53B (beat by 5.7%) and $3.35B a year ago.

EPS was $6.45 vs the year-ago $5.93. Results for the first quarter of 2024 include gains on sales of facilities of $201 million, or $0.57 per diluted share, primarily related to the sale of a hospital facility in California.

Revenue came in slightly above expectations at $18.32B vs consensus $18.26B (beat by 0.3%) and $17.3B a year ago.

“The solid fundamentals we saw in our business the past several quarters continued into the first quarter of 2025,” said Sam Hazen, Chief Executive Officer of HCA Healthcare. “As we look to the rest of the year, we remain encouraged by our performance, the overall backdrop of growing demand for healthcare services, and the investments we’ve made across our networks to serve our communities better.”

Same Facility metrics:

• Admissions: +2.6% (vs +6.2% a year ago)

• Equivalent Admissions: +2.8% (vs +5.2% a year ago)

• Revenue per Equivalent Admission: +2.9% (vs +3.5% a year ago)

• Inpatient Revenue per Admission: +2.4% (vs +6.6% a year ago)

• Inpatient Surgery Cases: +0.2% (vs +1.7% a year ago)

• Outpatient Surgery Cases: (2.1%) (same as a year ago)

• Emergency Room Visits: +4.0% (vs +7.2% a year ago)

Expenses (%):

• Salaries and Benefits: 43.6% vs consensus 44.6% (better by 100bps)

• Supplies: 15.1% vs consensus 15.4% (better by 30bps)

• Other Operating Expenses: 21.0% vs consensus 20.9% (missed by 10bps)

HCA Healthcare, Inc.’s balance sheet reflected cash and cash equivalents of $1.060 billion, total debt of $44.576 billion, and total assets of $59.798 billion.

Cash from Operations: $1.65B vs consensus $2.78B and $2.47B last year. Capex totaled $991 million, excluding acquisitions.

FY Guidance (Dec 2025) reaffirmed:

• Adjusted EBITDA: $14.30B–$15.10B vs consensus $14.69B (midpoint $14.70B vs consensus $14.69B, in line with expectations).

• Revenue: $72.80B–$75.80B vs consensus $74.53B (midpoint $74.30B vs consensus $74.53B, missed by 0.3%).

• Capital Expenditures: ~$5.0B to $5.2B (no direct consensus provided).

During the first quarter of 2025, the Company repurchased 7.762 million shares of its common stock at a cost of $2.506 billion. The Company had $8.259 billion remaining under its repurchase authorization as of March 31, 2025.

Key takeaways from the call:

• Outpatient surgery volumes slightly declined due to lower acuity cases; however, net revenue and earnings grew.

• Inpatient surgeries up ~1% per business day; overall volume activity solid across service categories.

• Net revenue per equivalent admission increased by 2.9%, driven by favorable payer mix trends and outpatient revenue growth.

• No significant changes in competitive dynamics observed; ongoing investments in high-acuity and outpatient capacities detailed.

• Labor market expected to remain stable with continued focus on workforce development initiatives.

HCA Healthcare was down about 4% on uncertainties around the new administration's stated priorities despite a solid report.

HCA Healthcare is held in HALO Technologies “Silver Haired Economy” thematic portfolio.

Postscripts: